Hello Sir,

Hope you are doing well.

Recently, we were looking at PPT of a real estate company which kept talking about highest ever quarterly sales in Q3 of Rs 500 cr +.

However, reported sales numbers were only Rs 200 cr +.

What's the catch here?

Let's understand:

Before that, a few days back we released our New Stock Recommendation for Alpha and Alpha + Members

It's a minerals processing company, largest in its segment, has captive raw material sources, grown PAT by ~300% in the last few years, de-leveraging balance sheet, 2nd generation promoters and available at only ~6 times post-tax earnings

You can get it along with other recommendations, by subscribing HERE

Revenue recognition in case of Real Estate stocks

- Unlike other products wherein buying raw material, processing and selling to customer takes 2-3 months. In case of real estate, project initiation, construction to final delivery can take 2-5 years

- Thus, real estate companies report different metrics which can be confusing

- In the above example when the company talks about Rs 500 cr + sales in Q3, it means 500 cr worth of flats booked by customers in Q3 the delivery of which will happen on project completion

- While reported sales of Rs 200 cr + meant final delivery of projects worth 200 cr to end customers in the quarter

So, how are real estate companies supposed to report sales to exchanges?

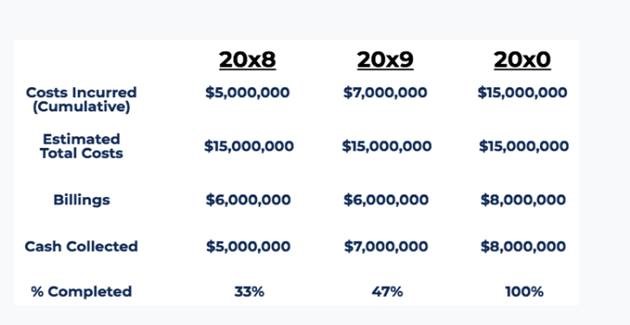

- Till FY18, Percentage of Completion method (POCM)

- Under POCM, revenue was recognized if actual construction and development cost (excluding land cost) incurred was 25% or more of estimated cost, or

- At least 25% of saleable project area was secured by contracts with buyers and at least 10% of the total revenue as per sales agreement is realized as of the reporting date

- Refer screenshots to understand revenue recognition based on POCM

- However, POCM was subject to a lot of manipulation. Further, a lot of projects remained unfinished while the companies recorded the sales

- On 28 March 2018, MCA notified Ind AS 115, revenue from a contract with Customers with effect from 1 April 2018

- Thus, from FY 19, real estate companies started reporting sales on Completed Contract Method (CCM) basis

- Under the same, revenue from contracts is recognized when control over the property has been transferred to the customer

- Under CCM, Revenue is recognized at a point in time, when:

- The company has transferred to the customer all significant risks and rewards of ownership and the company retains no effective control of the real estate unit to a degree usually associated with ownership.

- Thus, because of significant time lag (2-3 yrs) between the booking of the flat by customer to the ultimate delivery, companies share the following metrics in their PPT

- Booking sales (worth of flats booked)

- Reported sales (as per CCM)

- Collections (amount collected)

(End)

Disclaimer: The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address - 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur - 208002, Contact No. - +91-7275050062

Compliance Officer - Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal - Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No