Hello Sir,

Hope you are doing well.

Markets are at an all-time high and all the indices, be it small cap, mid cap, etc. all are doing well.

Jun’24 has proven to be an extremely good month for equity investors in general. Except for the major correction on 4th Jun’24, it’s been a smooth sailing.

As is often the case, whenever the markets have corrected sharply or have done well, the general question that comes to mind is…what next?

Instead of trying to predict what the markets will do next, we prefer looking at market sentiment.

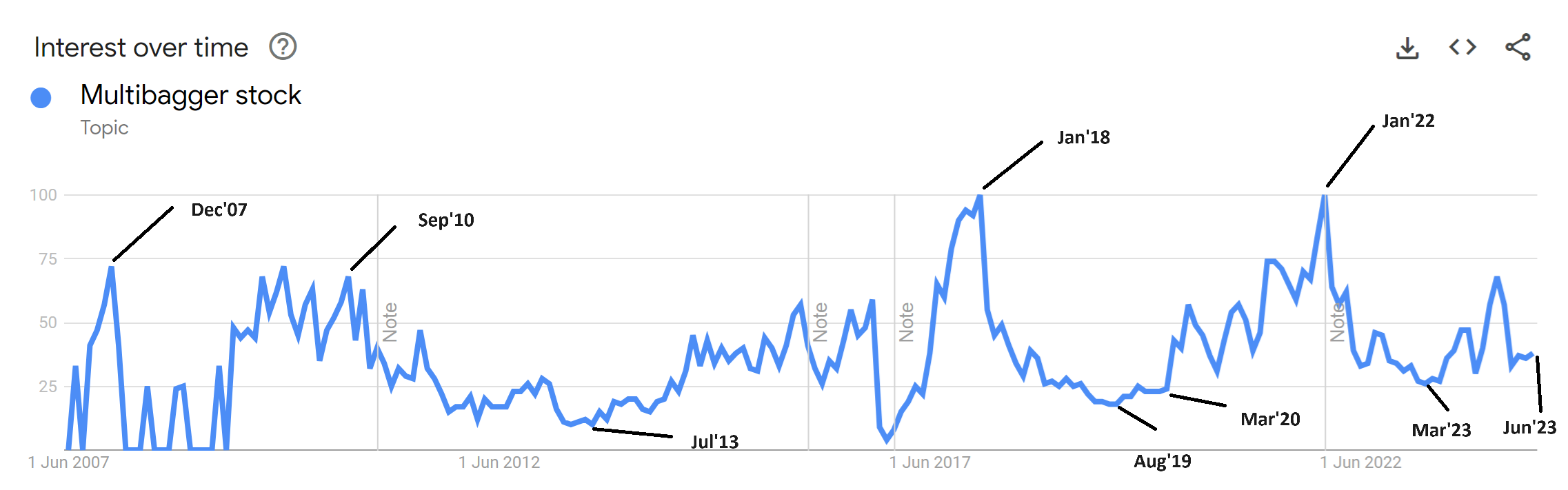

And the tool we use is basic google trends chart for the search term “Multibagger Stock”.

Surprisingly, such a basic tool has proved to be quite accurate in marking market tops and bottoms in the past.

As can be observed from the chart, the “Multibagger Stock” trends chart peaked around the same time markets peaked in the past: Dec’07, Sep’10, Jan’18, Jan’22.

Similarly, the “Multibagger stock” trends chart bottomed around the same time markets hit bottom in the past: Dec’08, Jul’13, Mar’20, Mar’23.

Value of Google trends at the end of Jun’24 was 38 which is closer to lows than highs.

However, for Jul’24, it has risen to around 53. As per Google, Jul’24 number is based on partial (incomplete) data. Thus, it will be important to check the number at the end of the month.

Normally, the danger zone has been around 65 or higher.

The value did reach around 68 in Jan’24 and post that we saw 10-12% correction in small-mid caps in Mar’24.

At least, as per the chart, a major correction looks some time away (probably a few months); however, one should surely be cautious in terms of stock selection at this point of time. There are certain pockets/sectors which are quite overheated and may prove to be risky.

Note: Any indicator is prone to errors and can’t be relied on completely. Also, in general, one should invest only that money in stocks which you think you won’t need at least for 3-4 years.

1 New Portfolio Stock Recommendation – Released a new stock recommendation for (opens in new tab)Alpha and Alpha + Members

- Key beneficiary of strong growth in Real Estate segment

- 100% + increase in sales in last 3 years and management targeting 20-30% sales CAGR for the next few years

- Improvement in product mix resulting in higher margins and ticket size

- Improving balance sheet with reduction in net debt and working capital days

- Attractive valuations and value unlocking through demerger

You can get the detailed report on the above stock and other recommendations by signing up (opens in new tab)HERE

(End)

Best Regards,

Ekansh Mittal

Research Analyst

Web: (opens in new tab)https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: (opens in new tab)[email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: (opens in new tab)http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, (opens in new tab)ekansh@

Grievance Redressal – Mittal Consulting, (opens in new tab)grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – (opens in new tab)LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No