In the last 17-18 months, the broader markets are down around 15-20%. In the past, we have seen bear markets lasting 2-3 years. While one cannot be sure of the length of the bear market, it’s a good time to be actively looking for growth stocks at reasonable valuations with an investment horizon of 3-5 years.

One good way to screen for such stocks is by tracking Promoter’s actions. If they have been consistently buying from the open market or increase stake through preferential allotment, one could add such stocks to watch list.

Today, we will look at Roto Pumps and how the performance of the company has turned around with great returns by the stock after a major corporate event.

This analysis can help identify such opportunities in future.

Help us grow: If you think our stock recommendations could add value to your friends, relatives, or acquaintances, we’d appreciate you spreading the word about Katalyst Wealth.

Before that: Here’s the list of new recommendations released by us in last few weeks

- For Insider Bets members – On 22nd Jan’26, we released our New stock report under “Insider Bets“ subscription. It’s a rare setup wherein Promoter is increasing stake via open market + preferential allotment, Valuations very reasonable at <10x earnings | <1x book and Earnings growth strong at 15%+ CAGR. You can access it by signing up HERE

- For Alpha/Alpha + members – On 31st Dec’25, we released a new long term investment recommendation for Alpha and Alpha + members. It’s a specialty products company which has delivered 20% + Sales and PAT CAGR, is net debt free, trading at attractive valuations with Price to Book value at 5 years low. You can access it by signing up HERE

Roto Pumps case study

- From FY 19 to FY 21, the performance of the company was largely stagnant

- During the period, consolidated sales remained range-bound between Rs 125 crore and Rs 135 crore; operating profit hovered around Rs 22-30 crore and PBT fluctuated between Rs 12 crore and Rs 18 crore with no clear upward trend

- However, since FY 21, there’s been a major turnaround in the performance of the company

- Sales are up from Rs 127 crore to Rs 298 crore, operating profit is up from Rs 28 crore to Rs 66 crore, and PBT is up from Rs 26 crore to Rs 53 crore

Source: Screener

- After trading in the Rs 8-12 range for around 2-3 years, the stock started doing well from Apr 2021 onwards

- Adjusted for the 1:1 bonus issue in Jul’23 and the 2:1 bonus issue in Jul’25, the stock went from around Rs 12 levels to an all-time high of around Rs 120, representing roughly a 10x return from the allotment price

Source: Screener

Question is, was there anything which could have alerted one to start tracking the stock and add to one’s watchlist before the significant improvement in performance and stock price happened?

- Yes, on 31st Mar’21, Board of Directors approved issue of convertible warrants to Promoters

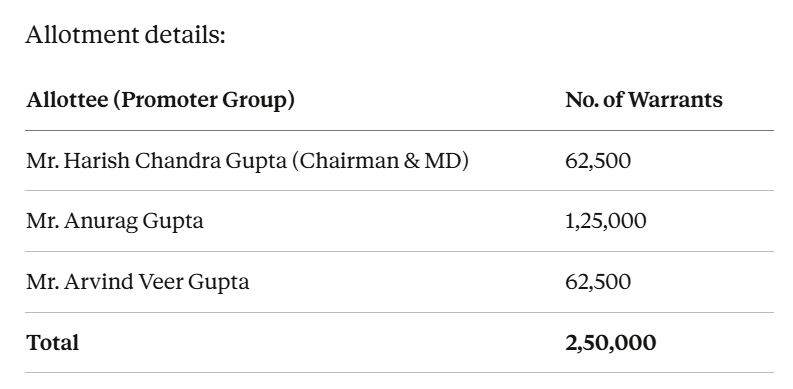

- On 19th May 2021, members of Roto Pumps approved (through Postal Ballot) the issue of 2,50,000 warrants to Promoter/Promoter Group at an issue price of Rs 142.11 per warrant

- Adjusting for bonus and split – 30 lakh warrants at Rs 11.84 per warrant

- The warrants were subsequently allotted on 7th Dec 2021 and converted into equity shares on 27th Jan 2022

Source: BSEINDIA

- Importantly, 100% of the warrants were allotted to Promoters. This is a very strong signal of promoter conviction compared to cases where allotment is split between promoters and non-promoters

- The allotment price of Rs 11.84 was roughly in line with the prevailing market price — indicating promoters were willing to invest at market rates, not at a deep discount

- A significant increase in Promoter holding through open market purchase or major allotment to Promoters is always an interesting sign and calls for deeper analysis of such companies

- Promoter knows more than anyone else about the business operations and if they increase stake, many a times it could be because they are finding value or anticipating positive developments

There might be many cases where the business and the stock may not have done well, post allotment of warrants to promoters during low phase. However, the idea is, screening for such stocks can be a good starting point for further research and to catch the turnaround stage early.

Hope you found the blog post useful and it added value to your investment decisions. Sign up for more interesting stock ideas and industry notes.

Disclaimer: This is not a recommendation to buy/sell any of the stocks mentioned above. The securities quoted are for illustration only and are not recommendatory.

Ekansh Mittal

Research Analyst

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Registered Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002

Place of Business – 205, Ratan Floor, 113/120, Swaroop Nagar, Kanpur – 208002

Compliance Officer/Grievance Redressal – Mr. Ekansh Mittal, +91-9818866676, info@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Use of Artificial Intelligence: RA may infrequently use Artificial Intelligence (AI) tools like chatgpt, notebooklm, etc. in its research services to enhance the quality and efficiency of the recommendations provided to clients. The tools are primarily used for data collection and generating con-call summaries for the purpose of research.

In accordance with Regulation 24(7) of the SEBI (Research Analyst) Regulations, 2014: We take full responsibility for the security, confidentiality, and integrity of client data used in conjunction with AI tools and we ensure compliance with applicable laws regarding the use of AI tools.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No