14-Year Track Record of Finding

High-Quality Small-Mid cap Stocks Before The Crowd

Deep fundamental analysis | Long-term wealth creation | Skin in the game

Tired of These Common Investing Problems?

You're not alone. Here's what most retail investors struggle with:

❌ Generic Stock Tips

YouTube gurus and Telegram channels giving tips on 50 stocks a month. How do you know which ones to trust?

❌ Missing Multibaggers

You hear about winning stocks AFTER they've already gone 5x-10x. You're always late to the party.

❌ Short-term Noise

Constant trading, intraday tips, F&O gambling. No strategy for long-term wealth creation.

Our Disciplined Framework for Building Wealth

Quality over quantity. Deep research over hot tips. Long-term compounding over short-term trades.

Screen 1,500+ Companies

We use financial filters, valuation metrics, and promoter-tracking algorithms to find hidden gems.

Deep Fundamental Analysis

15-20 page detailed reports explaining what to buy, why to buy, risks involved, and when to exit.

Continuous Updates

We don't just recommend and disappear. Regular updates, earnings call summaries, and exit guidance.

Transparent Tracking

We publish our recommendations transparently. Track our active and closed positions.

🔍 TRANSPARENCY - Our Live Track Record

We believe in complete transparency. Here's exactly what's happening with our stocks right now:

📊 Current Recommendations Status (As of Feb 2026)

(Alpha/Alpha+)

In Buy Zone

Active Recommendations

Period (months)

📋 Past Recommendations (Illustrative Only)

⚖️ Full Transparency: Not All Picks Work

We're honest about our misses because that's the reality of equity investing:

Why this is okay: Our philosophy is built on asymmetric payoffs. A stock can go up 5x, 10x, or more, but can only lose 100%. When 2-3 big winners give 5x-13x returns, they more than compensate for 3-4 small losses. That's how long-term wealth is built.

Want Access to Our Full Recommendations List?

Members get complete transparency: all recommendations, entry/exit prices, updates

SEBI regulations restrict sharing detailed performance data with non-clients. Full track record, including all active and closed positions with entry/exit prices and returns, is available to members. Past performance is not indicative of future results.

Choose Your Wealth-Building Plan

All plans include detailed research reports, regular updates, and exit guidance. No hidden fees.

Alpha

Best For: Conservative long-term growth investors

- 5-7 new stock recommendations per year

- Focus on growth at reasonable valuations

- Access to all past reports (active & closed)

- Regular updates via email + WhatsApp

- Tracker sheet to show how we would act on recommendations

- Investing lessons via reports & blog

Alpha+

Best For: Growth + Special Situation investors

- Everything covered in Alpha, PLUS:

- 4-6 Special situation opportunities based on Demerger, Buy-back, Delisting, Open offers, etc.

Insider Bets

Best For: High-risk, high-reward investors

- 5-7 new recommendations per year

- Focus on turnaround opportunities wherein Promoters themselves are investing or infusing funds

- Access to all past reports (active & closed)

- Access to corp. announcements based on preferential allotment

- Regular updates via email + Whatsapp

- Investing lessons via reports & blog

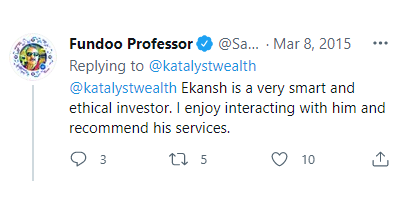

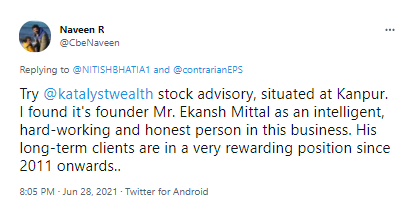

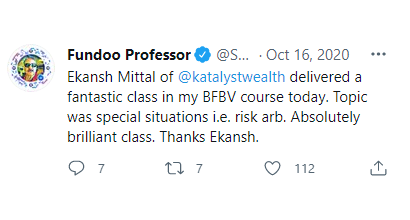

Ekansh Mittal - Founder & Chief Analyst

From reading Economic Times at 12 to building a SEBI-registered research firm featured in Forbes and ET.

- Started investing at 21 during the 2008 crash - learned resilience and risk management early

- Founded Katalyst Wealth in 2011 - Served from zero to 2,000+ satisfied clients over 14 years

- Featured in Forbes India for early identification of emerging businesses and disciplined approach

- Skin in the game: Personally invested in most of the recommendations - we eat our own cooking

- SEBI Research Analyst since 2015 | Registration No. INH100001690

- Philosophy: Quality over quantity. Fewer well-researched ideas outperform frequent trading

Frequently Asked Questions?

What is Katalyst Wealth?

KatalystWealth.com (here in referred to as “Katalyst Wealth”) is the domain owned by Mittal Consulting (Ekansh Mittal is the Sole Proprietor). We offer independent equity research services to clients on subscription basis. SEBI (Research Analysts) Regulations 2014, Registration No. INH100001690, BSE Enlistment No. 5114.

At Katalyst Wealth we provide stock recommendations while focusing on long term wealth creation. We follow the principles of Growth cum Value investing and compounding. We have been recognized by FORBES, ET and Outlook Business for our investing prowess.

How are we different from other research firms?

At Katalyst Wealth we believe in the philosophy of “Put your money where your mouth is”. We invest in most of the stocks we share reports on.

We make money when you like our research and renew your subscription. Thus, our entire focus is on the quality of research and the stock ideas than the number of stock ideas.

For whom all are the services suitable?

Our services are suitable for investors with the following profile:

- If you are focused on wealth creation and investment horizon is 3-4 years or more

- If you are looking for good stock recommendations with regular updates including entry and exit

- If you can handle short term market corrections for longer term wealth creation

- If your objective is to combine investing with learning

- If you are an experienced investor and looking for a good source of stock ideas

What are Special Situation Opportunities?

Markets are full of mispriced opportunities. Demergers, Delisting, Buybacks, Open Offers and many more such events if carefully studied can unlock good value in a short time span of 3-6 months.

What are Insider Bets?

The idea behind Insider Bets is that Promoters know about their company more than anyone else and if they are increasing stake or investing more funds in the company, especially during the downturn, then it might signal that the promoter is either finding value at lower prices or anticipating a turnaround in the company's or industry's fortunes in the coming years.

Premium Member's Dashboard

Premium members get access to dashboard which consists of the following sections:

- Alpha and Alpha + Investment Reports

- Alpha and Alpha + Updates

- Special Situations

- Alpha Tracker

- Alpha + Tracker

- Important Corporate Announcements

- Insider Bets Investment Reports

Media

Blog Posts

Get In Touch

Monday - Friday

10am - 5pm

Registered Address: Flat 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur - 208002

Principal place of business: 205, Ratan Floor, 113/120, Swaroop Nagar, Kanpur - 208002

WHO WE ARE

www.katalystwealth.com (herein referred to as 'Katalyst Wealth') is the domain owned by Mittal Consulting (Ekansh Mittal is the Sole Proprieotor). Ekansh Mittal Proprietor M/s Mittal Consulting is SEBI Registered Research Analyst and offers Independent Equity research services to investors on subscription basis. SEBI (Research Analyst) Registration No. INH100001690, BSE Enlistment No. 5114.

Copyright ©2025 Mittal Consulting. All rights reserved.

Compliance Officer/Grievance Redressal - Mr. Ekansh Mittal, +91-9818866676,info@

“Registration granted by SEBI, Enlistment as RA with exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

SEBI Northern Regional office (NRO) - NBCC Complex, Office Tower-1, 8th Floor, Plate B, East Kidwai Nagar, New Delhi - 110023