Dear Readers,

Countless studies have been done on investor psychology, yet mystery remains. A field known as behavioral finance has evolved over the time to offer better understanding of how emotions and cognitive errors influence investors and decision making. The most intriguing behavior that still eludes behavioral finance experts is the one that comes in plenty at times of market tops and bottoms. In big bull markets, investors remain blind to risks, while they remain double-blind to opportunities in market declines. It is fascinating to observe that investors who were willing to bid any price at peaks are now willing to even give a second glance at prices that one-fourth of their peaks.

What explains this rather irrational behavior? It goes back to two basic human emotions greed and fear. It is not so much about lack of awareness of either risk (in bull markets) or opportunities (in bear markets) that is driving this behavior. It is rather our misguided confidence (coupled with greed and fear) that is behind this dynamics. We, humans, overestimate our ability to out-smart the crowd at exit and entry. At the peak of a bull market, it manifests in the form of false confidence that when the music stops, you can not only stop dancing, but also can rush to the exit comfortably. But peoples miss the hangover and gate-crashing effect. Not to forget the stampede and the fatal consequences that follow. This is what happens when everyone in the crowd thinks that he/she can outsmart the other (bigger fool theory!). Precisely the same illusion blinds us, but in reverse, at the bottom of the market.

The problem gets further compounded because of the presence of false and misleading sharp corrections in the bull markets and strong rallies in the bear markets. Trying to time the market is the most common mistake and is also one of the most expensive, especially at market bottoms in terms of missed opportunities.

In this back-drop, it is important to be aware of the common follies to which the investors are vulnerable, especially in a sharply declining market like the current one. Some of them are as below:

- It is a terrible mistake to wait for the comfort of the economy to turn around. History tells us that markets hit the bottom much before the real economy hits the bottom. The opposite is true as well. Taking cue from the 1930 depression, the US markets were already up 30% when the real economy hit the bottom in March 1933. Same is the case in successive slowdowns in the US in 1942 and in the late 1980s.

- ‘Cash is King is another mistaken notion which most investors have, especially when markets are down. Holding cash (or cash equivalents like deposits etc.) can only give an emotional comfort of not waking up to sharp erosion in portfolios every morning. It is a poor asset to choose as it is likely to under perform even inflation, leave alone equities over the long-run. So trading long-term gains for short-term emotional relief with cash/FDs does seem insane.

- Disproportional focus on macro is another folly. Macro being the function of so many inter-related constantly evolving variables, trying to get a grip on this by mindless dancing to every tune of macro data smacks of irrationality. Ironically, the world of analysts and scholars can’t get enough of this. While it may be intellectually stimulating to track and grasp the complex macro; to base investment decisions completely on macro outlook is a poor substitute to simple time-proven bottom-up stock picking.

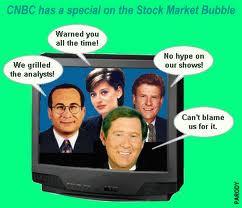

- Investors need to be aware that they pay a heavy price for blindly following both the optimists and the pessimists. Opinions and views are no substitutes for hard-data and ground-up research. One needs to be extremely careful about acting on the basis of breathless headlines and views that are flashed 24X7. Most of them have very little utility value for genuine long-term investors.

To sum up, it is time to be judiciously greedy and not to get carried away by the panic-packed noise. As someone wise said, time to invest is when drums are beating, not when trumpets are blaring.

(Source: Economic Times)

Katalyst Wealth