Hello Sir,

Hope you are doing well.

Recently I came across Som Distilleries & Breweries. It’s been an 8+ bagger since Mar’21.

8 bagger is fine. The question is how could one have picked the stock in Mar’21 for the subsequent gains?

The company reported one of its worst performance in FY 21 with both operating and net losses. Despite the poor performance in FY 21, let’s check out, how could one have picked the stock in Mar’21 before the performance started improving in FY 22 and thereafter.

If you remember, we have been saying, look for what the Promoter is doing. Promoter knows better than most about the company, industry and if he is picking up stake during the downturn, it becomes even more interesting.

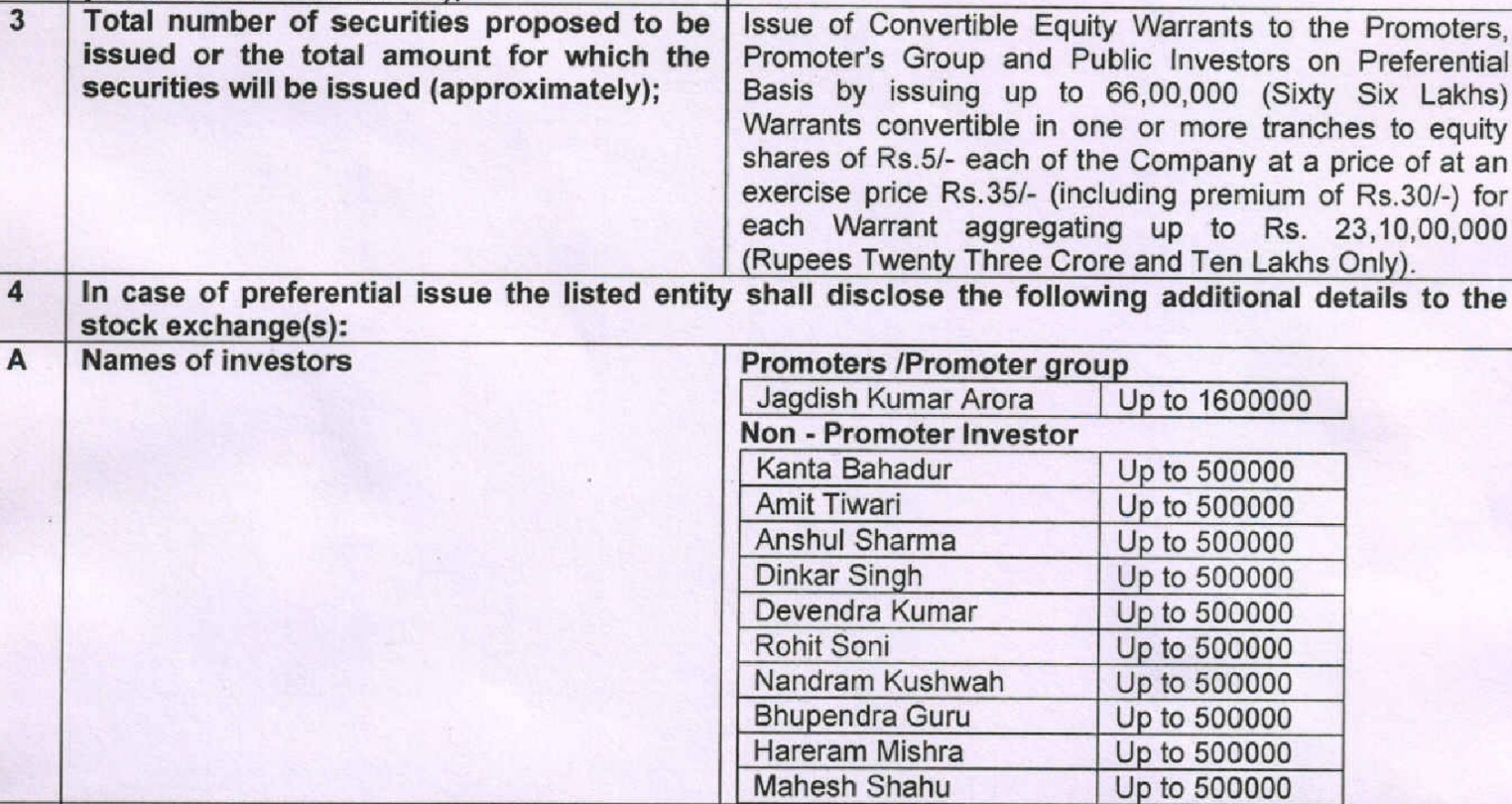

So, in the case of Som Distilleries, I came across this Preferential warrant announcement to Promoters and non-promoters on 15th Mar’21 at Rs 14/- each (adjusted for stock split from Rs 5/- to Rs 2/-). Just for context, CMP – 106.

This was after the stock had corrected from the highs of 55-60 odd levels in May 2018 and the company had the worst year in terms of the business performance.

In our view, in general, it indicates that Promoters are finding value at such low prices or are expecting improvement in performance going ahead.

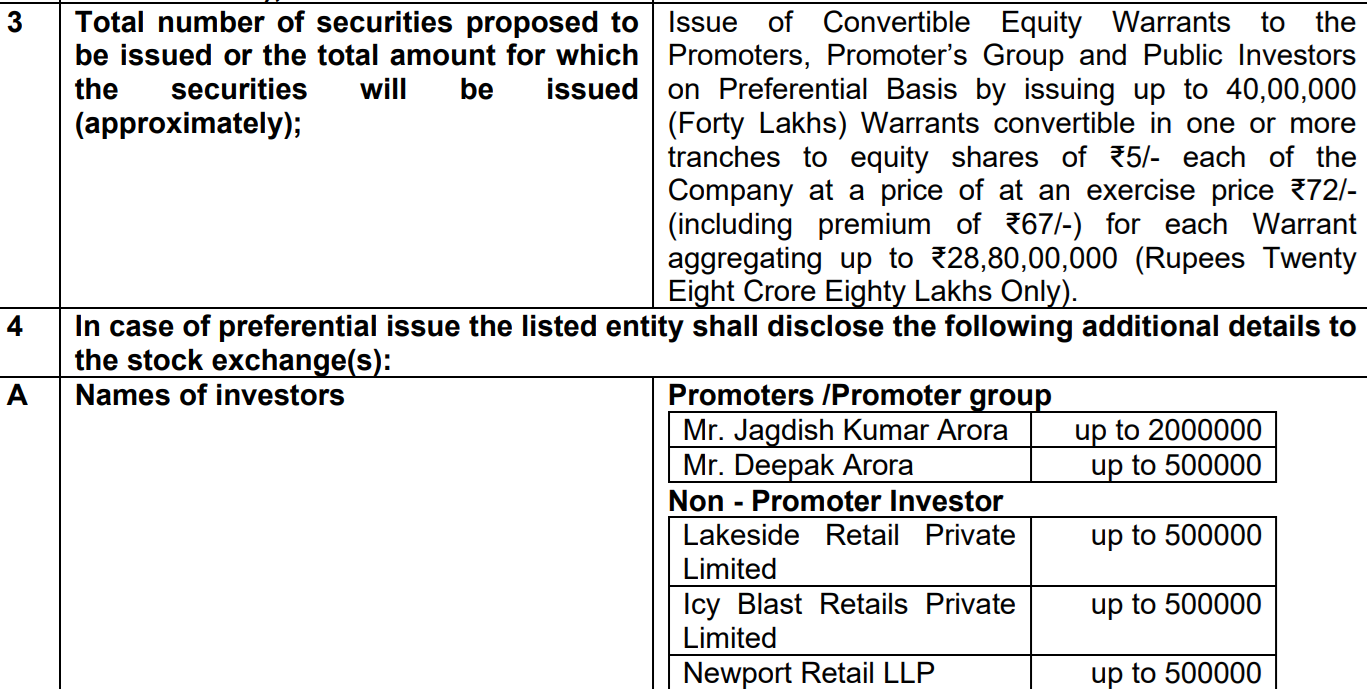

While this preferential allotment didn’t materialize as the proposed allotees did not subscribe to the warrants within the prescribe timelines, on 14th Jul’22, the company announced another board meeting to issue convertible warrants to Promoters and other prospective investors.

Around that time, the stock was still quoting around 28-30 odd levels.

Eventually, on 20th Jul’22, the board approved issue of convertible warrants to Promoters and other investors at Rs 28.8/- each (adjusted for stock split from Rs 5/- to Rs 2/-).

This time, promoters took a larger share of warrants at 25 lakhs out of total 40 lakhs, indicating their confidence in the prospects of the company.

As it turns out, FY 23 was a bumper year for the company with 120% jump in sales, 400% jump in operating profit and a turnaround in net profit from loss of 10 crore in FY 22 to 60 crore PAT in FY 23.

Thus, preferential allotment announcement to promoters in Mar’21 could have been a good trigger point for a deep dive into the company or to start with a minor allocation.

You can find curated Preferential allotment announcements under Alpha + subscription @ https://katalystwealth.com/

Update: As on 25th Aug’24, 22 medium/long term stock recommendations are under coverage. Out of the same, 7 are both Positive rated and in the buy zone.

You can get the detailed report and the stock recommendations by signing up HERE

(End)

Disclaimer: This is not a recommendation to buy/sell any of the stocks mentioned above. The securities quoted are for illustration only and are not recommendatory.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002, Contact No. – +91-7275050062

Compliance Officer – Mr. Ekansh Mittal, +91-9818866676, ekansh@

Grievance Redressal – Mittal Consulting, grievances@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No