In the last 15 months, broader markets are down around 15-20%. What’s good though is that investor’s sentiment and participation is also down as reflected by Google trends data, Avg. daily turnover data of NSE and the latest Market Breadth data.

It’s a great time for stock picking and portfolio restructuring. Those who will invest in growth stocks trading at reasonable valuations today, will probably make great returns on portfolio over the next 3-5 years.

Let’s look at the Market Breadth Data of Jan 2026, how it compares with past periods and what cues can one take from the same.

Before that: Here’s the list of new stock recommendations made recently:

- For Alpha/Alpha + members – On 31st Dec’25, we released a new long term investment recommendation for Alpha and Alpha + members. It’s a specialty products company which has delivered 20% + Sales and PAT CAGR, is net debt free, trading at attractive valuations with Price to Book value at 5 years low. You can access it by signing up HERE

- For Insider Bets members – On 26th Nov’25, we released our 6th stock report under “Insider Bets“ subscription. It’s a fast growing company with 150% growth in sales and 300% growth in PAT in last 4-5 years. Valuations are attractive at around 10 times pre-tax earnings and Promoters are buying the stock from open market. You can access it by signing up HERE

Market Breadth Data Jan 2026

(As posted by Mr. Nooresh Merani)

This is what real corrections look like (beyond index levels).

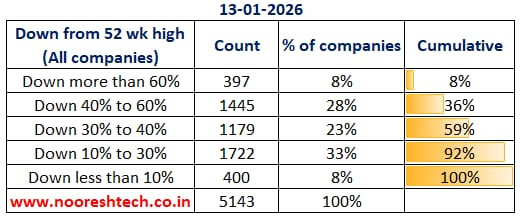

As of Jan 2026: 59% of all listed stocks are down more than 30% from their 52-week highs

Breakup:

- 36% stocks down >40%

- 8% stocks down >60%

This is not a shallow pullback.

How does this compare historically?

% of stocks down >30% from 52-week highs:

- Jan 2026: 59%

- Mar 2009: 94% (GFC crash)

- Aug 2013: 64% (taper tantrum)

- Aug 2019: 75% (NBFC crisis)

- May 2022: 57%

- Mar 2023: 56%

- Jan 2025: 61%

Current phase is:

- Similar to May 2022 & Mar 2023

- Less severe than 2019

- Nowhere close to 2009 or 2013

In short: Meaningful correction, not a meltdown.

Where is the pain concentrated? – Mostly in small & micro-cap stocks (< ₹10,000 cr mkt cap)

The long-term investor’s lens – Historically, phases like this:

- Don’t feel comfortable

- Don’t feel obvious

- Don’t come with good headlines

But they often create the best risk-reward setups for patient investors.

Especially if your horizon = 3–4 years.

Bottom line – Corrections don’t announce bottoms. They quietly prepare future leaders. This is the phase to research, build watchlists and accumulate selectively.

Hope you found the blog post useful and it added value to your investment decisions. Sign up for more interesting stock ideas and industry notes.

Disclaimer: This is not a recommendation to buy/sell any of the stocks mentioned above. The securities quoted are for illustration only and are not recommendatory.

Ekansh Mittal

Research Analyst

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

Registered Address – 7, Panch Ratan, 7/128, Swaroop Nagar, Kanpur – 208002

Place of Business – 205, Ratan Floor, 113/120, Swaroop Nagar, Kanpur – 208002

Compliance Officer/Grievance Redressal – Mr. Ekansh Mittal, +91-9818866676, info@

“Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors”.

“Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Use of Artificial Intelligence: RA may infrequently use Artificial Intelligence (AI) tools like chatgpt, notebooklm, etc. in its research services to enhance the quality and efficiency of the recommendations provided to clients. The tools are primarily used for data collection and generating con-call summaries for the purpose of research.

In accordance with Regulation 24(7) of the SEBI (Research Analyst) Regulations, 2014: We take full responsibility for the security, confidentiality, and integrity of client data used in conjunction with AI tools and we ensure compliance with applicable laws regarding the use of AI tools.

Disclaimer: You can access it here – LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No