Dear Sir,

It’s been a stock picker’s market since few years now. So, while benchmark indices like SENSEX, NIFTY haven’t delivered very strong returns, individual stocks have multiplied investor’s wealth by 5, 10, 15 times and even more.

We constantly strive to achieve 25% + annualized return (at 26% CAGR you double your wealth every 3 years and grow it to 10 times in 10 years) on our savings (you can’t beat 7-8% inflation comprehensively in the long run with your FDs and Gold holdings) and in our bid for the same we look for stocks (businesses) that have the potential to grow at the above mentioned rate over the longer run and share detailed reports and regular updates on such companies with our Alpha and Alpha+ members.

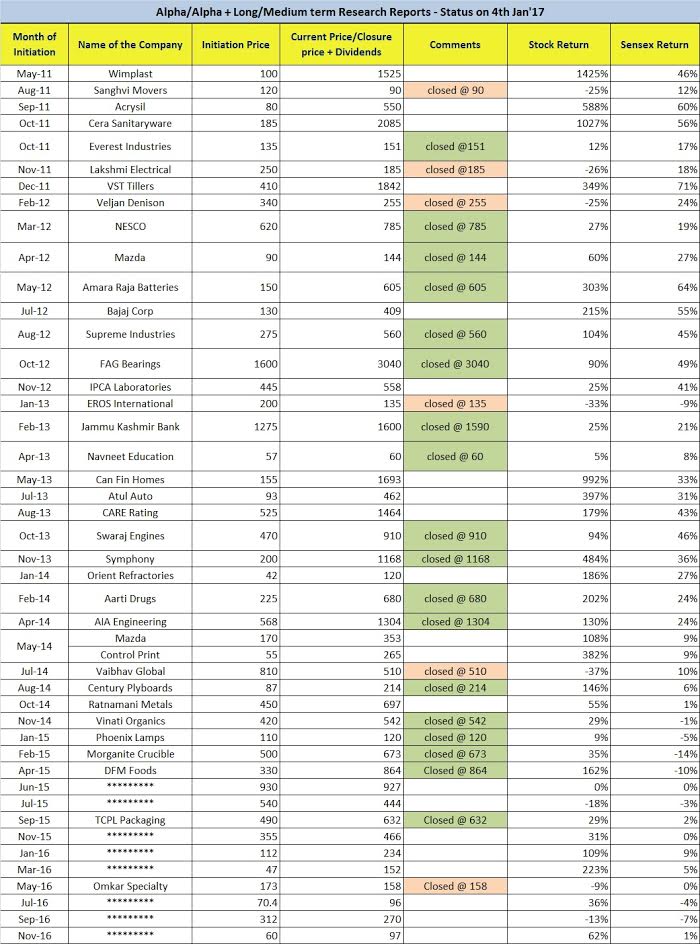

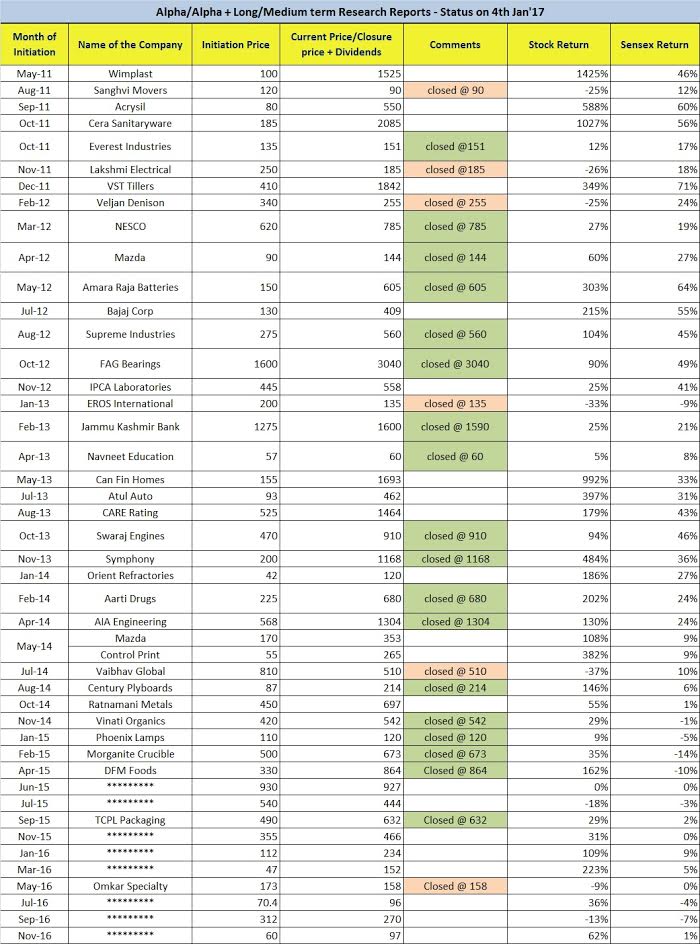

Please find below very detailed snapshot (Jan 2017) of Long/Medium term Investment reports and Special Situation opportunities covered in Alpha +

Performance Snapshot

Long/Medium term Investment reports – Performance highlight

These reports are covered in both Alpha and Alpha + (You can check the stock names HERE)

45 Long/Medium term investment reports initiated in last 5.5 years

36 reports above initiation price (closed – 18)

9 reports below initiation price (closed – 6)

No. of reports 1400% above initiation price – 1

No. of reports 1000% above initiation price – 2

No. of reports 900% above initiation price – 3

No. of reports 500% above initiation price – 4

No. of reports 400% above initiation price – 5

No. of reports 300% above initiation price – 9

No. of reports 200% above initiation price – 12

No. of reports 150% above initiation price – 15

No. of reports 100% above initiation price – 20

No. of reports 50% above initiation price – 25

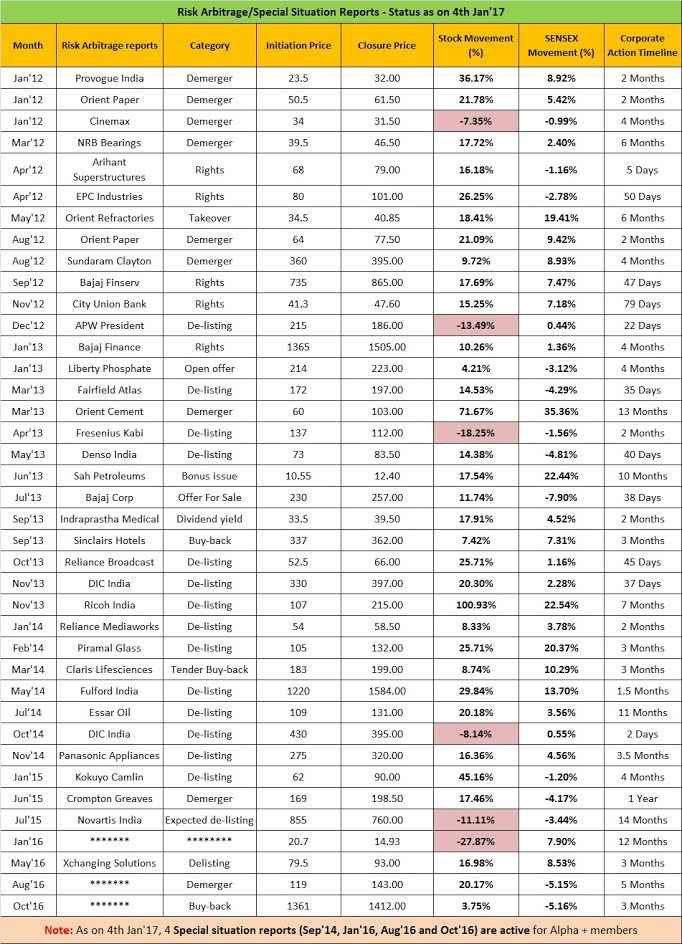

Special situation opportunities – Performance highlight

These reports are covered only in Alpha + (You can check the stock names HERE)

40 Special situation/Risk arbitrage reports initiated in last 5 years

No. of opportunities above initiation price – 33 (closed 31)

No. of opportunities below initiation price – 7 (closed 5)

Average holding time line – 3-4 months

No. of opportunities 15% above initiation price – 23

Note: We provide equity research services. This is not an investment advice and is a track record of research reports initiated by us. The performance data quoted at www.katalystwealth.com represents past performance and does not guarantee future results. For detailed disclaimer – check HERE

Best Regards,

Ekansh Mittal

Research Analyst

https://www.katalystwealth.com

Ph.: +91-727-5050062, Mob: +91-9818866676

Email: [email protected]

Disclaimer: www.katalystwealth.com (here in referred to as “Katalyst Wealth”) is the domain owned by Ekansh Mittal. Mr Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to retail clients on subscription basis. SEBI (Research Analysts) Regulations 2014, Registration No. INH100001690

Use of the information herein is at one’s own risk. This is not an offer to sell or solicitation to buy any securities and Ekansh Mittal/Mittal Consulting/Katalyst Wealth will not be liable for any losses incurred or investment(s) made or decisions taken/or not taken based on the information provided herein. Information contained herein does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors. Before acting on any recommendation, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek an independent professional advice. All content and information is provided on an “As is” basis by Ekansh Mittal/Mittal Consulting/Katalyst Wealth. Information herein is believed to be reliable but Ekansh Mittal/Mittal Consulting/Katalyst Wealth does not warrant its completeness or accuracy and expressly disclaims all warranties and conditions of any kind, whether express or implied. Mittal Consulting, its proprietor may hold shares in the company/ies discussed herein. The performance data quoted represents past performance and does not guarantee future results.