NTPC Buy-Back – Special Situation Opportunity

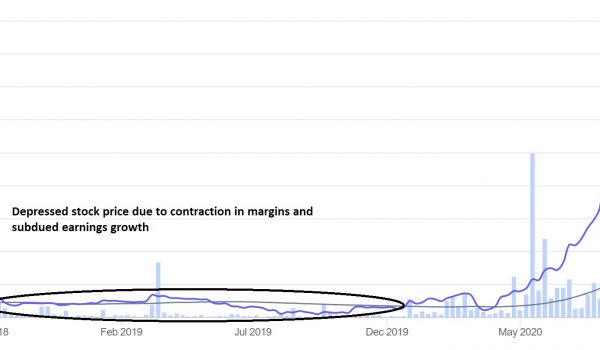

Dear Members, We have released 7th Nov’20: Special situation opportunity on the proposed buy-back of shares of NTPC Ltd (NSE Code – NTPC). The same has also been produced below. For details and other updates, please log into the website at the following link – https://katalystwealth.com/index.php/my-account/ Note: For any queries, mail us at [email protected] Date: 7th Nov’20 CMP – 87.35 (BSE); 87.25 (NSE) Rating – Positive – 3% weightage; this is not an investment advice (refer rating interpretation) …