Dear Sir,

The extent of extreme polarization in Indian markets cannot be overstated. We had talked about Polarization a few weeks back (LINK) and recently came across some very important data points and thought of sharing them with you.

So, as is evident from the above data, the top 20 stocks have cornered the entire gains over the last 22 months starting Feb’18. All others are in general down. However, as we will see below, this isn’t happening for the first time.

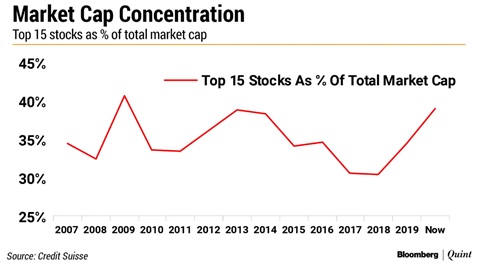

In 2009, 2012-14 as well, similar kind of polarization played out, though not to the same extent. As can be noticed from the above picture, in 2009, top 15 stocks accounted for more than 40% of the total market cap. Similarly, the numbers were again around 40% in 2012-14. And now, in 2019, we have again breached the 40% mark for top 15 stocks.

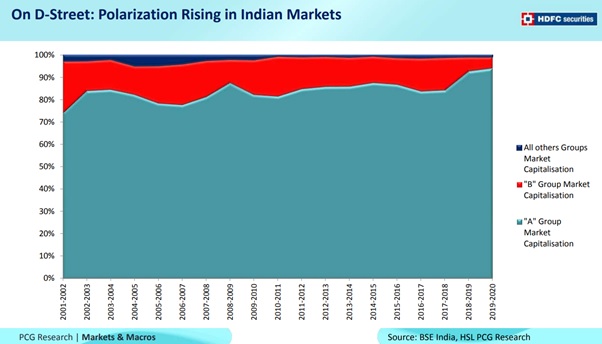

Similar info is being conveyed from the above data by HDFC securities. “A Group” Market capitalization was higher than normal in 2002-03, then in 2009 and now again in 2018-19. In fact, the “A Group” market capitalization is highest in 2 decades at around 94% of the total market cap in 2019.

We believe, while the future is unknown, we can always take some cues from the past. As investors in small and mid cap stocks, we obviously don’t like the fact that only the top 20 stocks are performing well and the others are down; however, looking at the past, this is also probably a great investment opportunity.

Why we think so? For multiple reasons. Firstly, leaving aside the top 50-100 stocks, we all know that stocks in general are down significantly. Thus, valuations are in favor of investors.

Secondly, again taking cues from the past, everytime such polarization occurred, be it 2002-03, 2009, 2012-14, broader markets recovered sharply in subsequent years and proved to be significant wealth creators for equity investors.

Over the years, we have started appreciating the cyclical nature of the markets greatly and believe staying put through bad markets and being able to take a contrarian approach is what differentiates good investors from bad.

To know more about our Stock advisory and Model Portfolio services, check out the following page – https://katalystwealth.com/alpha-3/

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676