Dear Sir,

Hope you are doing well.

Today, I would like to share with you our thought process on how to identify stocks with low downside risk and potential for high pay offs.

I think you will agree with the following two facts:

- All the businesses are cyclical to varying extents and go through lean periods, and

- Best returns are generated when a company goes through both Earnings and PE expansion

Thus, if you combine the two, we get the formula for low risk high reward opportunities:

“Basically, if we can identify Good Companies going through Depressed Earnings Cycle and thereby depressed valuations, the downside risk reduces considerably; while when the cycle turns around, the stock can end up delivering substantial gains on account of both earnings’ expansion and PE re-rating”

The question is how does one know if it’s a good company or not? Well, without complicating much, if one sticks to basics like: a business you can understand, low leverage on the balance sheet, decent past track record, high promoter holding, operating cash flows matching reported earnings (over longer periods), etc, you will easily know if the company is worth considering or to be simply put into avoid basket.

A more detailed checklist can be accessed here – LINK

Now, I would like to illustrate with 2 examples as to how the above strategy helped us identify stocks that ended up delivering substantial gains in an overall tough environment.

New/Returning Member

You can subscribe to Premium Memberships at the following LINK

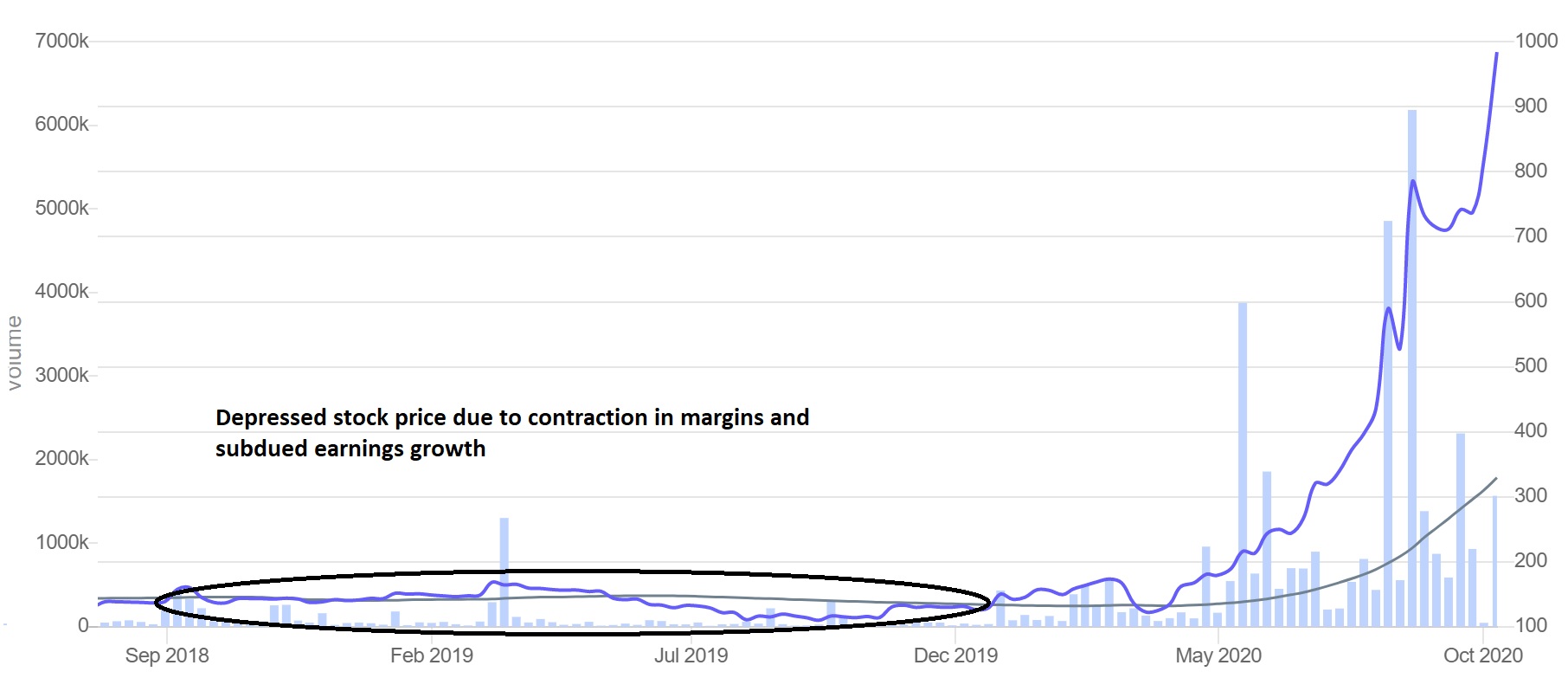

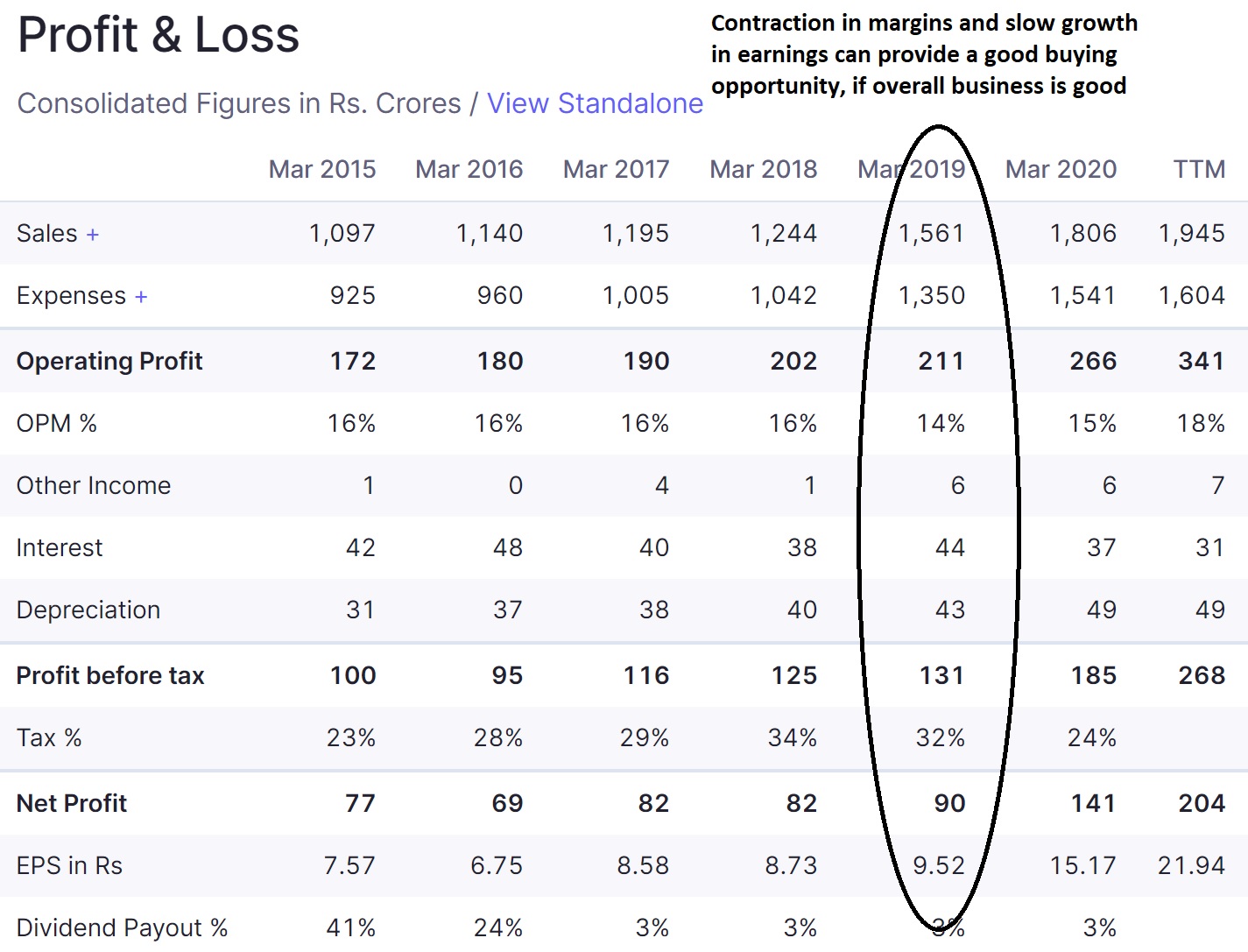

Case#1 – Aarti Drugs

We initiated the stock on 30th Sep’18, i.e. FY 19 around 137 odd levels (adjusted for bonus). We knew that the company is good; however, in terms of earnings it was going through a lean period due to one-off events such as slow demand in Q1 of FY 18 in the run- up to implementation of Goods and Services Tax Act, fire at one of its plants in Q4 of FY 18 and contraction in margins in Q1 of FY 19.

Source: Screener.in

Before Q1 FY 19, the company was consistently delivering 16% operating margins; however, the margins contracted to 14% in Q1 FY 19.

Thus, as a result of slightly depressed earnings and general apathy towards Pharma stocks, the stock was available at 13-14 times earnings against the highs of 20 times earnings a few years back.

What’s important to note here is that lower valuations were on already lower earnings and thereby the probability of any major deterioration in earnings or the stock price was quite low.

Source: Screener.in

Luckily, due to a combination of factors, the earnings have improved and even the PE has re-rated substantially, resulting in ~500% gain on the stock.

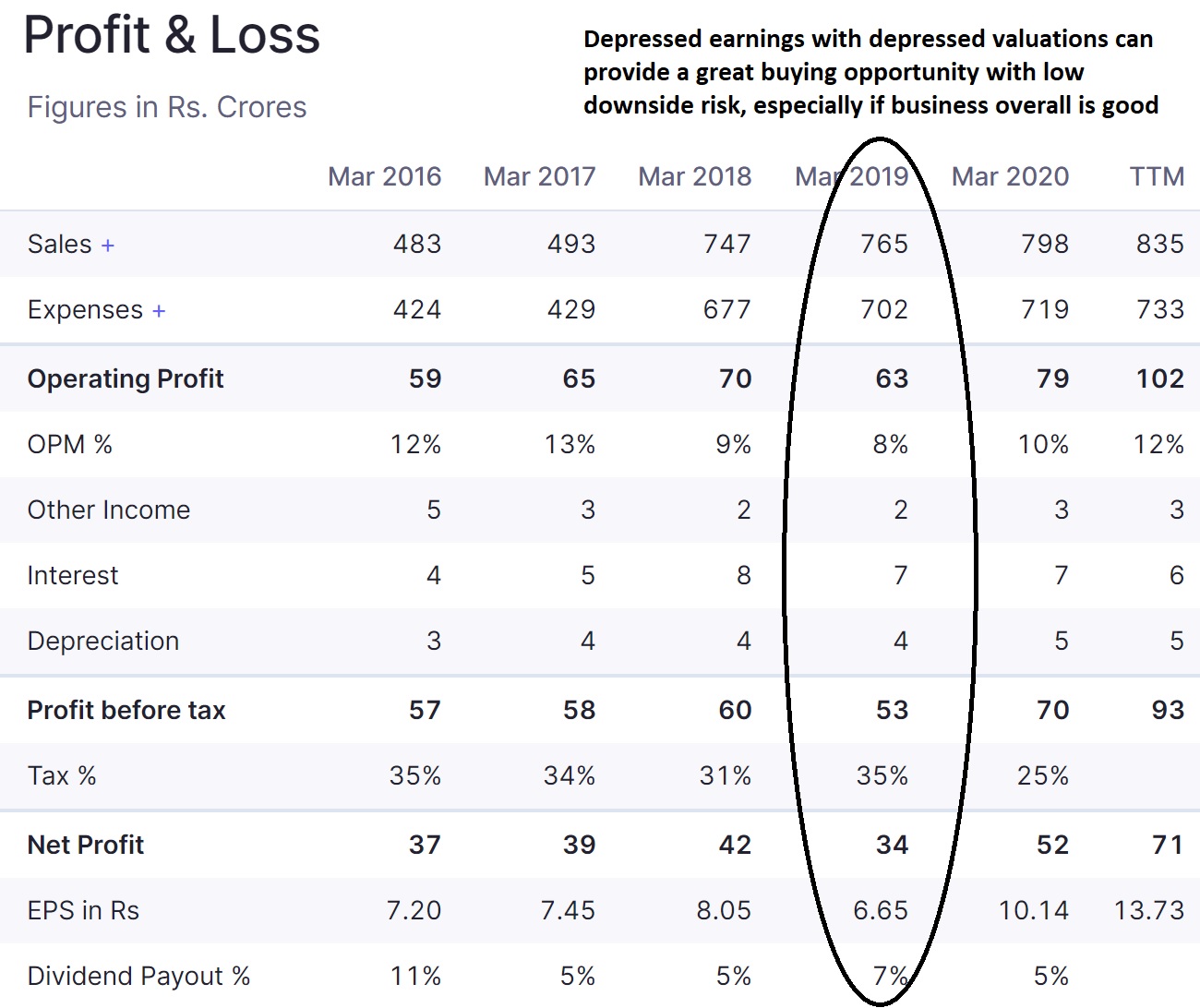

Case #2 – Chaman Lal Setia

The company is into basmati rice production and trading which is more or less a commodity business and getting hold of the earnings cycle around lows can be greatly rewarding.

Source: Screener.in

We initiated the stock on 29th Sep’19 around 46 odd levels. Here again, we knew that the company is good and the business is deeply cyclical. So, when the operating margins of the company contracted to 5-6% in Q1 and Q2 FY 20 against the highs of 12-13% a few quarters ago, and combined with that the stock also corrected to 40-50 levels from the highs of 150-200, we thought the further downside is low and initiated the opportunity.

Then, the stock was trading at 7-8 times earnings and that too on cyclically low earnings.

Source: Screener.in

Luckily, the earnings have doubled since then while the PE is still the same and that’s why the stock has also doubled.

It’s important to remember that no strategy is fool-proof and there will always be cases wherein you will incur losses; however, the idea is to have small losses and large gains.

Note: The above examples are only for educational purpose and are neither a recommendation on the stocks or reflective of our current view.

Wish you Good Health and Wealth

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://katalystwealth.com/

Email: [email protected]

Ph: +91-727-5050062, Mob: +91-9818866676

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Analyst ownership of the stock: None

By subscribing to Alpha/Alpha Plus, you agree to accept the following terms/conditions:

www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690. The model sheet service is an extension and reflection of our research analysis and is in no way a portfolio advisory or buy/sell recommendation for you.

The purpose of model sheet is to get a tentative performance snapshot on portfolio basis than on individual stock basis. It is basically a Performance measuring tool, similar to say an index.

The model sheet service is basically an information service and doesn’t take into account your personal financial situation or risk profile. Please consult your financial adviser before following or implementing the same partially or in totality.

The transactions mentioned are not the actual transactions, but take into account the ending prices for the day and ~0.3% transaction charge.

For the purpose of calculation of returns, the surplus cash (cash i.e. not invested in stocks) will be assumed to be invested in liquid funds at around ~5-6% return per annum.

There’s zero refund policy because as soon as you subscribe to the same you get access to the complete portfolio snapshot.

Details of Associates: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report

Disclaimer: www.katalystwealth.com (here in referred to as Katalyst Wealth) is the domain owned by Ekansh Mittal. Mr. Ekansh Mittal is the sole proprietor of Mittal Consulting and offers independent equity research services to investors on subscription basis. SEBI (Research Analyst) Regulations 2014, Registration No. INH100001690

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

A graph of daily closing prices of securities is available at www.bseindia.com (Choose a company from the list on the browser and select the “three years” period in the price chart.

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclosure (SEBI RA Regulations)

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, Aarti Drugs in Father’s and Wife’s account

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No