Hello,

Hope you are doing well.

We have released our new stock recommendation for our Premium Members and would like to share with you details on the same.

It’s a processed food products company selling both in India and in more than 40 + countries under its own brand. After India, US is its 2nd biggest market wherein its has grown its sales 10 times in the last 4-5 years.

Despite a very strong and well known brand and massive growth in the US business, the company is still available at 10 times FY 23 (E) earnings.

Some basic financial numbers about the company are as below:

- Industry – Food

- Market cap - < than 5,000 crore

- PAT growth (FY 16-20) – 30% CAGR

- USA sales growth – Rs 18 crore in FY 17 to Rs 180 crore in FY 21

- USA PAT growth - Rs 2.5 crore in FY 17 to Rs 30 crore in FY 21

- Debt to equity – 0.50

- PE – 9.7-11.5 times FY 23 (E)

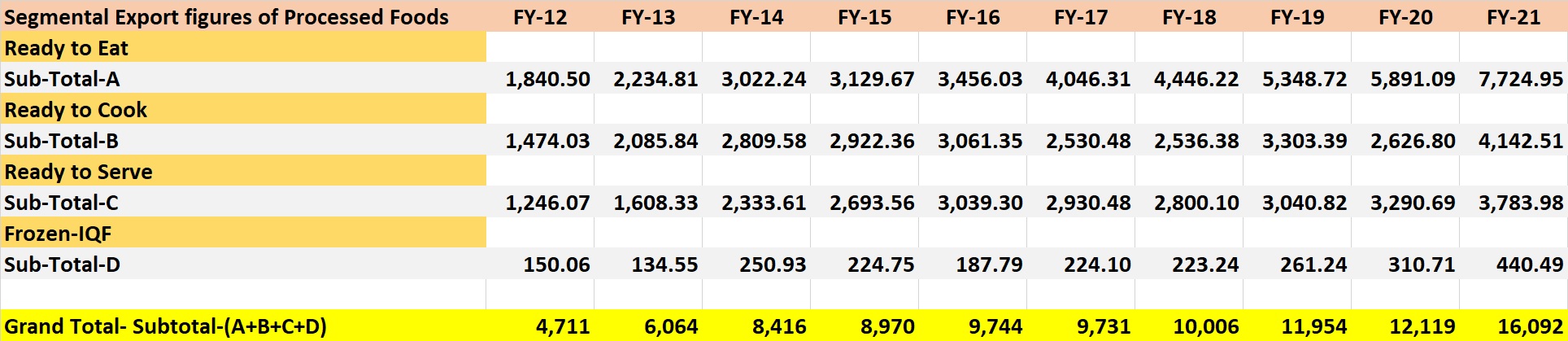

- Massive growth (double digit) in processed food exports from India on consistent basis

Source: agriexchange.apeda

Besides the extraordinary numbers and reasonable valuations, what more do we like about the company –

- Over the last 4-5 years, the international sales of the company have exploded from Rs 50 crore to Rs 200 crore +

- The USA business of the company has grown 10x in 4 years

- The EBITDA margins in the US business are 20% + against around 11-13% in the domestic business. Thus, massive scope for expansion in profits with higher contribution of the US business

- Till FY 15, US was contributing negatively to the profits of the company and now it accounts for 50% of the PAT of the company on normalized basis

- Company is the largest exporter of certain foods items to the US

- A few years back, a private equity deal for a similar company happened at 2.3 times sales. If the market starts valuing the company similarly, the stock can appreciate by 150% on the basis of re-rating alone

Overall, looking at several positive transformations, excellent track record and reasonable valuations, we have recommended the stock to our members and also added it to our model portfolios and smallcases.

If you are looking for investment opportunities do check out our premium subscriptions.