Hello Sir,

Hope you are doing well.

Inflation is hitting hard on account of rising commodity prices – be it crude oil, metals and even the crop prices are rising.

As the crop prices are rising, farmers have been benefiting in the form of higher realizations resulting in higher usage of crop enhancement ingredients - fertilizers, insecticides, pesticides, etc.

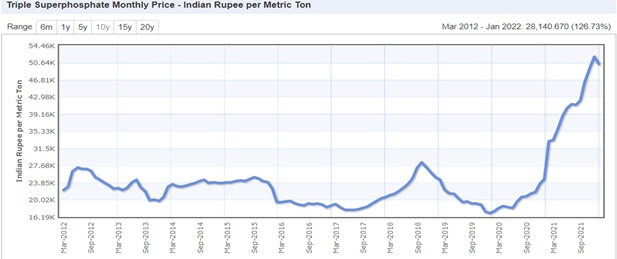

We decided to look at some of the stocks in the fertilizer space and also as to how the fertilizer prices are moving and have been pleasantly surprised by the huge upward movement in the prices of key fertilizers like – DAP, Urea, Single and Triple Superphosphate.

Before that, if you are interested in investing in an Agrochemical company that will benefit immensely from the ongoing rise in the prices of farm output and food inflation and where the management is expecting strong 20% + year on year growth, you can read about it here - LINK

So, what’s exactly happening in the fertilizer space – As can be noticed from the charts below, the prices of major fertilizers have increased 2-4x since Mar’20 and this is not only true of India but across the world.

Source: indexmundi

Source: indexmundi

Source: indexmundi

Why have the fertilizer prices been increasing since Mar’20?

2020-21

- Strong demand from key crop-growing regions was the driving force behind high fertilizer prices. Agriculture commodity prices, such as corn and soybeans rallied amid tighter supplies and strong demand. Higher farm revenue increased crop acreage and application rates of key nutrients like phosphates and potash.

- Phosphates raw material costs, particularly sulphur and ammonia, increased sharply as refinery curtailments due to COVID-19 restrictions limited supplies. Urea feedstock costs also rose, including natural gas prices which jumped in early 2021 due to unusually cold weather.

- U.S. natural gas prices doubled between the summer of 2020 and the end of 2021, which significantly raised the cost of nitrogen production. Energy is also a component of phosphate and potash mining costs.

- Shipping costs increased dramatically in 2021, especially on shipments from Asia to North America

2022

- Russia temporarily banned fertilizer exports in the month of Feb-2022, which gave a boost to already higher fertilizer prices

- Countervailing duties imposed by the United States on phosphate imports from Morocco and Russia have disrupted trade flows. Furthermore, there are indications that similar trade actions could be applied to alleged unfair subsidies for urea and ammonium nitrate

In the Indian context, it is important to remember the following key points -

- In the case of urea, the government fixes the MRP (Maximum Retail Price) and compensates the manufacturers for the difference between the MRP and the production cost.

- The prices of non-urea fertilizers like DAP, SSP and MOP are fixed by private companies and the government provides them a fixed amount of subsidy.

Thus, subsidy announcement by government becomes a key point in analysing Indian fertilizer companies because unless there's commensurate subsidy, rising fertilizer prices won't necessarily help Indian companies or could hit their volumes if farmers are unable to pay higher prices.

Currently, we have 1 company under coverage from the fertilizer space - Shree Pushkar Chemicals and Fertilizers. You can read the detailed report on the same @ LINK

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected]

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – Yes, in Shree Pushkar Chemicals and Fertilizers

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No