Hello Sir,

Hope you are doing well.

In order to recommend the best stock ideas to our members for their portfolios, our team does extensive research, goes through all the corporate announcements on daily basis and screens for various potential investment opportunities.

Through [Stocks to watch] email, we would like to share with you interesting stock updates we come across while performing our research. Hope you find them useful for your own investments or to add the stocks to your watchlist:

Before that, if you are interested in investing in an Agrochemical company that will benefit immensely from the ongoing rise in the prices of farm output and food inflation and where the management is expecting strong 20% + year on year growth, you can read about it here - LINK

International Conveyors – I think you must be already aware that, Promoters, being closest to the business, have most information about the nuances of the business. They are better informed of the expected performance of the company.

Thus, as Peter Lynch said, “If insiders are buying, then there can be only one reason that the company is likely to report improvement in performance in future”.

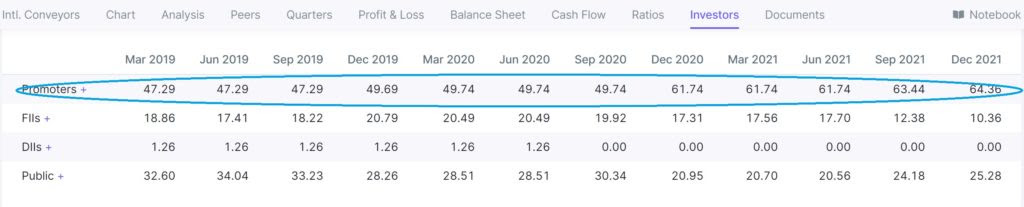

So, recently we came across a company “International Conveyors” and the interesting bit is that in the last 3 years Promoters have increased their holding in the company by a crazy 17%, i.e., from 47.29% in Mar’19 to 64.36% in Dec’21.

Source: Screener

We haven’t done detailed research on the company but looking at the huge increase in promoter holding, it seems like Promoters are quite gung-ho about the conveyor belting business in the years ahead.

Sandur Manganese & Iron Ores – This is important if you are invested in the company or planning to invest in it.

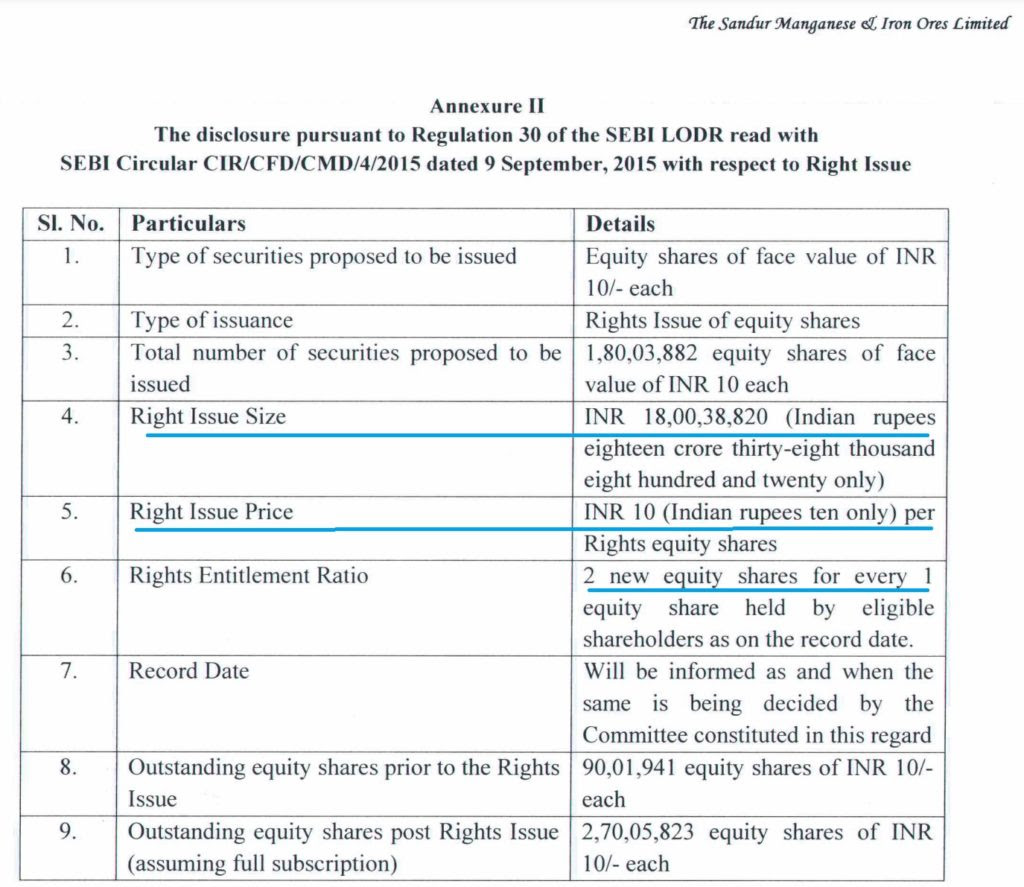

On 10th Apr’22, Sandur Manganese informed the exchanges about the Board approval for the rights issue with the following key details:

- CMP – 4738

- Rights Issue price – 10

- Rights issue ratio – 2 shares for 1 share held by the shareholders

- Money being raised – Rs 18 crore

Source: BSE India

So, rights issues are used by the companies to raise funds by issuing shares to existing shareholders so that their stake doesn’t get diluted.

Here, company will be issuing 2 new shares for every 1 share held by the shareholders at Rs 10/- per share.

So, if you are invested in the company or planning to invest, it’s important for you to know that you cannot afford to miss participating in right issue because on ex-rights date, the stock will come down to 1,586 from current levels of 4,738.

Why will it come down to 1,586? – The calculation for ex-rights price is simple and as follows:

[(1 * 4738) + (2 * 10)]/3 = 1,586

If you miss out on participating in rights issue, some other shareholder will apply for extra rights and get the benefit.

Disclaimer: This is not a recommendation to buy/sell International Conveyors and Sandur Manganese & Iron Ores. These updates are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected]

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No