Hello Sir,

Hope you are doing well.

Today, we will learn about Solar Pumps industry.

Solar Pumps industry - Will PM-KUSUM scheme prove to be a game changer? Also, which companies are active in Solar pumps industry?

PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evem Utthan Mahabhiyan) - This scheme was launched by the Ministry of New and Renewable Energy (MNRE) for the installation of solar pumps and other renewable power plants across the nation.

It was launched in 2019 with 3 components.

Before that, if you are interested in investing in our Latest Stock Recommendation which could benefit from the massive growth expected in the CNG segment and still available around 10 times earnings, you can read about it here - LINK

Component - A: For setting up of 10,000 MW of Decentralized Grid Connected Renewable Energy Power Plants on barren land. Under this component, renewable energy based power plants (REPP) of capacity 500 kW to 2 MW will be setup by individual farmers/ group of farmers/ cooperatives/ panchayats/ Farmer Producer Organizations etc.

The power generated will be purchased by local DISCOM at pre-fixed tariff

Component - B: For installation of 17.50 Lakh off-grid/stand-alone solar agriculture pumps. Under this Component, individual farmers will be supported to install standalone solar agriculture pumps of capacity up to 7.5 HP for replacement of existing diesel agriculture pumps / irrigation systems in off-grid areas, where grid supply is not available.

Pumps of capacity higher than 7.5 HP can also be installed, however, the financial support will be limited to 7.5 HP capacity.

Component - C: For Solarization of 10 Lakh On-Grid Connected Agriculture Pumps. Under this Component, individual farmers having grid connected agriculture pump will be supported to solarize pumps. The farmer will be able to use the generated solar power to meet the irrigation needs and the excess solar power will be sold to DISCOMs at pre-fixed tariff.

Objectives of the scheme

To increase the income of farmers and provide sources for irrigation, de-dieselize the farm sector, reduce dependency on grid power, low electricity billing and additional income by selling surplus electricity back to the grid.

For Components B and C, the details of the financial assistance from the Centre and the State Governments are as follows:

- Central Financial Assistance (CFA) of 30% of the benchmark cost or the tender cost, whichever is lower. State Government subsidy 30%; Remaining 40% by farmer

- In North Eastern States, Sikkim, J&K, Himachal, Uttarakhand, Lakshadweep and A&N islands, CFA of 50%, State Government subsidy 30%, remaining 20% by farmer

How does the scheme work?

- Step 1 – Farmer submits interest for Solar equipment and contributes 10% to State Nodal Agency

- Step 2 – MNRE contributes 30% to State Nodal Agency (MNRE is controlled by Central Govt.)

- Step 3 – State Govt contributes 30% to 60% (including loan to farmers at subsidized rates, if any) to State Nodal Agency

- Step 4 – State Nodal Agency opens tender and issues work order to the bidder

- Step 5 – Bidder supplies materials to farmers and completes installation

- Step 6 – Bidder submits document to the Nodal Agency for the release of the payment against the work completed

- Step 7 – Nodal Agency verifies the installation and releases the payment to the Bidder

Source: Shakti Pumps Presentation May-2022

Source: Shakti Pumps Presentation May-2022

Status of KUSUM scheme?

KUSUM Scheme – 1.0:

- Total Size of Order: 1,50,000 Solar Pumps

- Total Executed Qty – 78,940

- Shakti Pumps alone executed 22,340 pumps (28%) of the total installed pumps

- The Government will decide for the remaining quantity, i.e., whether to carry forward it to KUSUM – 2.0 or scrap the quantity

KUSUM Scheme – 2.0:

- Total Size of Order: 3,17,000 (not final yet, but tentative)

- Shakti pumps expected to execute 1,00,000 pumps order out of the same

- As per various sources, the average cost of a 5 HP solar pump installation is around Rs 2.5 lakh

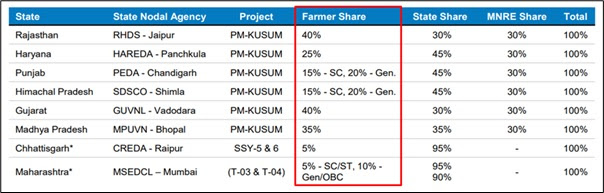

Key states where the PM-KUSUM scheme is active

Key players in the Solar Pumps industry

Tata Power, Shakti Pumps Ltd and other MSME’s firms.

Tata Power manufactures solar panels and outsources rest of the components. Shakti Pumps outsources solar panels from Adani and other suppliers and manufactures rest of the components such as SS structures, copper motor, VFD, etc., in house.

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock research for over a decade now.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: https://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No