Hello Sir,

Hope you are doing well.

In this mail, we will briefly discuss how to value cement companies based on the replacement cost method.

Basically, highly cyclical businesses like Metals, Cement, etc can deliver excellent returns if bought during cyclical lows.

To determine if the sector is going through cyclical low or not, you could look at operating performance of several companies in the sector. If they are reporting lower utilization levels, lower gross and operating margins than historical average, the sector might be going through a bad phase and could throw up good investment opportunities assuming there’s a turnaround in the next 2-3 years.

Another way one could determine if the sector is going through a bad phase is by comparing the current valuations of the companies against their replacement cost. This is most common in the case of Cement sector.

Here, it’s important to know that markets ascribe different valuations to different companies within the same sector depending on the size, efficiency, profitability and the growth outlook.

So, when comparing the current valuations with the replacement cost, it’s important to look at the historical valuations range of a particular company. Now, let's look at how to use replacement cost method.

Before that, if you are interested in investing in our Latest Stock Recommendation which could benefit from the massive growth expected in the CNG segment and still available around 10 times earnings, you can read about it by Clicking HERE

How to use Replacement cost method?

I will explain this using example of Anjani Portland Cement Ltd (APCL). We recommended this stock in May’19 as we found the stock to be quite cheap on replacement cost valuation method.

Note: We have already closed the coverage on APCL and currently, we don’t have any recommendation on Anjani Portland and this is only being used as an example to understand the concept.

So, back in May’19, APCL had 1.16 MTPA (million tonnes per annum) integrated cement unit, backed by limestone reserves and 16 MW captive power plant.

The market cap of the company was Rs 390 crore. The company was debt free with surplus cash of around Rs 20-25 crore and therefore the enterprise value was Rs 370 crore.

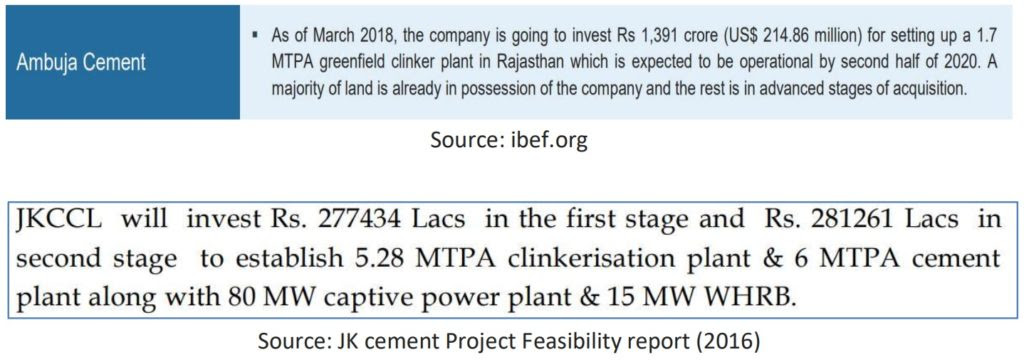

We decided to check as to how much it costs to set up a greenfield 1 MTPA integrated cement plant and found the following details:

From the above data, it was clear that setting up a greenfield 1 MTPA integrated cement unit costs around Rs 800-900 crore.

While in the case of APCL, we were getting 1.16 MTPA integrated cement unit, backed by limestone reserves and 16 MW captive power plant for Rs 370 crore, i.e., around 0.35 times the replacement cost.

We thought that 0.35 times was quite low and during an upturn in the sector, it could trade at 0.7-0.8 times.

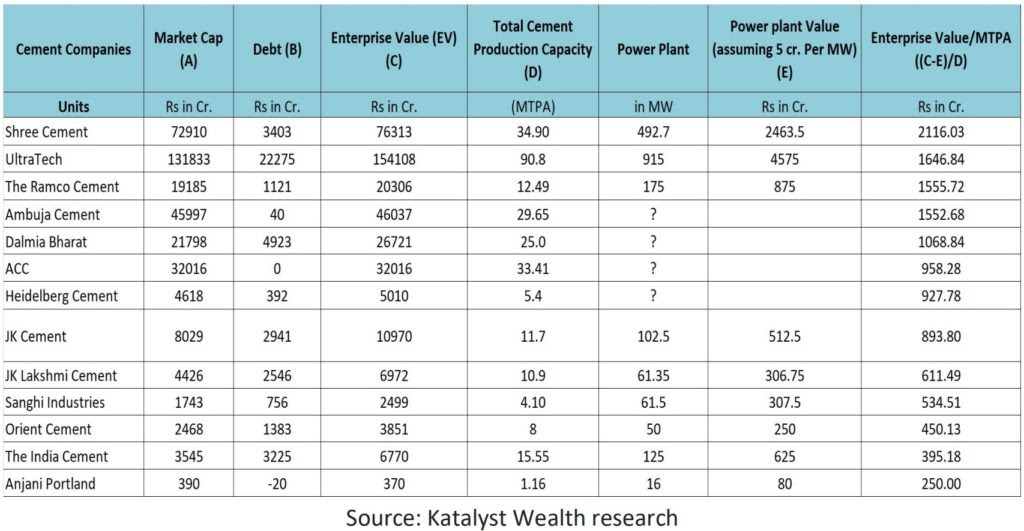

We had also shared the following table with Premium Members detailing Enterprise Value/MTPA for different cement companies in May’19.

As mentioned above, market ascribes different valuations to different companies based on a variety of factors and therefore it becomes important to check historical valuations of each company.

Recently, we were again looking at current costing for setting up integrated 1 MTPA cement plant and for most of the companies it is in the range of Rs 900-1,000 crore.

(End)

If you are looking for investment opportunities do check out our premium subscriptions. We have been helping our clients with our stock recommendations for over a decade now.

Disclaimer: This is not a recommendation to buy/sell Anjani Portland Cement. It has been used as an example to understand the concept of replacement cost valuation method.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: https://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No