Hello Sir,

Hope you are doing well.

Did you know? - In wood panels industry in India, MDFs contribution is only around 20-30% and plywood accounts for 70%; however, worldwide 45-50% is MDF, 45-50% particle board and minuscule contribution from plywood.

The usage of MDF is expanding rapidly in India and being a capital intensive industry, there are a handful of major players.

Below, we have shared notes from Q1 FY 23 concall of Rushil Decor which is a major player in the MDF and the laminate segment. Sometime back, the company completed a major expansion in the MDF space and is now gradually improving the capacity utilization. Hope you find the details useful in your search of investment opportunities.

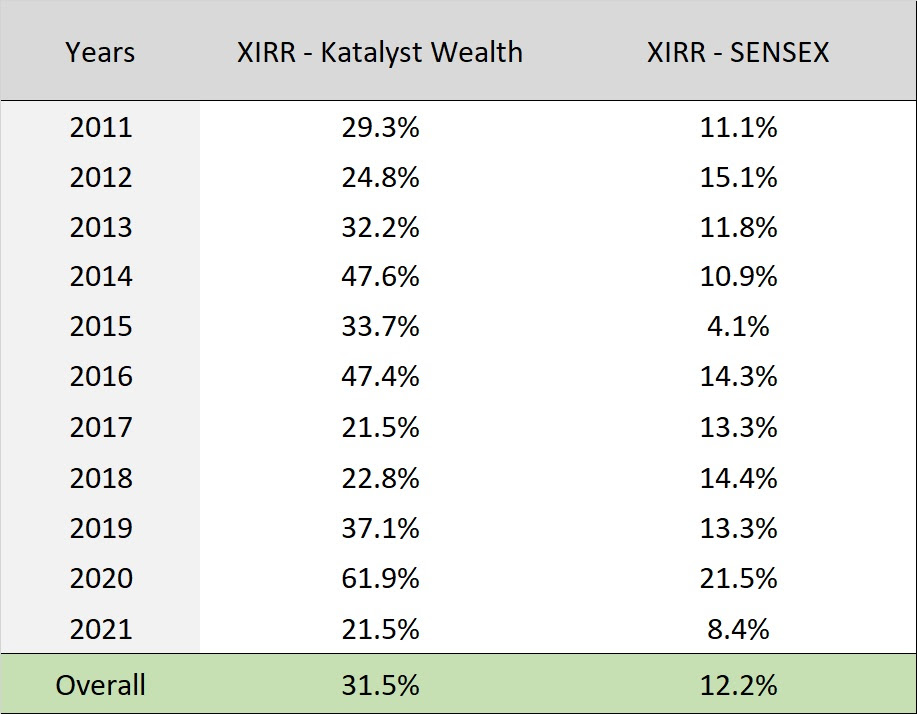

We have been running stock recommendation services since 2011. For the sake of transparency (good, bad, everything), we have put up the entire list of recommendations (as latest as Sep'22) for everyone to see @ - Click HERE

Rushil Decor - Notes from Q1 FY 23 con-call

- In the quarter, several positive points emerged for Rushil Décor. The ever increasing experience combined with an excellent team delivered one of the most fabulous results for us.

- The MDF segment showed a very significant growth in terms of EBIDTA and overall profitability with capacity utilization. We have been striving to increase the capacity utilization at the AP plant and at the same time, we are focused on reducing the cost and increasing our efficiencies.

- Our other focus has been to gradually increase our exports and enhance the value added contribution.

- EBIDTA margin from MDF segment stood at 27.45% and overall EBIDTA margin was 22.55% in Q1 FY 23

- In terms of raw material pricing for specific chemicals, we are witnessing stable or I would say downtrend leading to low cost pressure.

- Laminates:

- We achieved capacity utilization of over 84% in the quarter under discussion. And we achieved the highest turnover in a single quarter

- We believe that now the pricing is quite stable and exports, if we talk about US dollar, it's little bit volatile. So we see that in coming days, the performance may improve

- We have a business model where in we have some products which we export to Gulf region, some products we say export to far south-east Asia, Europe, some products in domestic market

- For laminate we really don't see any import competition

- MDF:

- The utilization at the AP plant stood at 73%. We have set target in terms of higher capacity utilization and increasing the value added contribution

- In total, for the Q1 it would be around 19,000 Chikmagalur, and for the AP plant, it is around 40,000. So overall, if we calculate the total capacity utilization, it's roughly about 58,700 cubic meters

- So far there is no constraint in terms of increasing capacity. I think reaching to 110% efficiency is not a big issue because this German Technology, they have a very conservative rating. When we talk about 100%, we can reach up to 110% too

- In Chikmagalur plant it was around 32.22% EBIDTA and in AP plant it was 24.55%. And if we consider average, it was around 27.45% for MDF business

- Value addition we have almost reached 29% now. For the Vizag unit, it's almost 10-12%

- MDF opportunity:

- We are expecting the growth rate between 15-20% annually for MDF product and when we talk about panel industry in general, MDF contributes around 20%, 30%, not more than that. And 70% is contributed by plywood segments. worldwide it is like 45 - 50% is MDF and 50 - 55% is particle board.

- There are a lot of organized furniture makers and startups are coming up. And these people, they normally prefer MDF rather than plywood and other kind of products. We also see a huge possibility to export our materials and a lot of places, today we have replaced Thailand and Vietnam in Gulf region

- New supply in MDF:

- If you put up any MDF plant, it normally takes 2 to 3 years. If you talk about the MDF CAGR, it's almost 15-20%. If someone puts up around 1000 CBM per day and if we talk about existing rate of 6,000 CBM consumption pattern, then also this capacity will be easily absorbed in the market

- Yes, I do agree when there is a new capacity in the market, for some time there's little bit of pressure on pricing

- MDF capacity in India - Capacity available is almost like 2.3 million CBM per year and I assume that capacity utilization was almost like 1.8 to 1.9 million CBM

- Foreign currency debt - It would be around 30% of the total outstanding debt. The foreign currency debt was basically for Andhra Pradesh project only, and it was from German Financial Institution. As of now the outstanding would be around 21 million.

- Finance cost - In terms of foreign currency the finance cost is hardly 0.85%. And if you see overall finance cost would be in the range of 6.5%.

- Guidance - Q1 FY 23, we are sitting on 22.55%. The way we are positioned as of now, I think, we'll be able to maintain this margin 1 or 2% here and there. Overall, I think it should be in the range of 20 - 21. That is what I think, we are thinking for.

(End)

Disclaimer: This is not a recommendation to buy/sell Rushil Decor. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No