Hello Sir,

Hope you are doing well.

Markets have corrected a bit in the past few sessions. As they say, it takes a prepared mind to capitalize on the opportunities and we therefore keep searching for new Investment opportunities.

Recently, Valiant Organics came to our notice. This stock did extremely well from Oct'16 to Nov'20 and went up almost 10 x during the mentioned period. However, since Nov'20, the stock is down 60% and this is what got us interested.

Off-late the performance of the company has also turned bad with a sharp dip in margins and profitability.

Below, we have shared notes from the Q1 FY 23 presentation of the company to know the reasons for the dip in performance. Hope you find them useful for your own investments or to add the stock to your watch list:

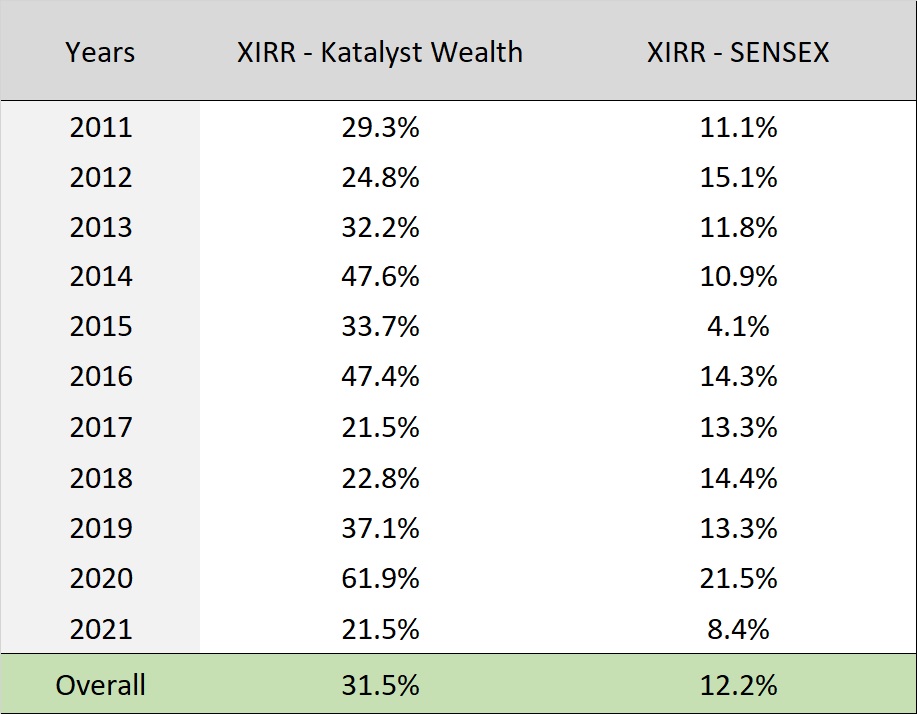

We have been running stock recommendation services since 2011. For the sake of transparency (good, bad, everything), we have put up the entire list of recommendations (as latest as Sep'22) for everyone to see @ - Click HERE

- One of the largest Chlorophenol derivatives manufacturer globally

- One of the largest domestic PNA manufacturer

- Amongst 1st few domestic PAP manufacturers

- One of the leading manufacturer of Benzene derivatives products

- Diversified client base across Pharmaceuticals, Dyes & Pigments, Agrochemicals and specialty chemicals

- Total Production Capacity of 70,000 TPA

- Key chemistry includes Chlorination, Hydrogenation, Ammonolysis, Acetylation, Sulphonation, Methoxylation amongst others

- Primarily focused on manufacturing specialty chemicals that have a high demand but low supply and are primarily dependent on imports

- FY 22 revenue share - 31% hydrogenation, 31% ammonolysis, 29% chlorination and 9% others

- Manufacturing footprint -

- CHLORINATION – SARIGAM • Capacity: 18,000 MTPA

- AMMONOLYSIS - VAPI • Capacity: 9,000 MTPA

- AMMONOLYSIS - TARAPUR • Capacity: 6,600 MTPA

- HYDROGENATION & METHOXYLATION - JHAGADIA UNIT 1 • Capacity: 27,000 MTPA

- HYDROGENATION – JHAGADIA UNIT 2 • Capacity: 12,000 MTPA

- ACETYLATION & SULPHONATION – AHMEDABAD • Capacity: 1,800 MTPA

- Q1 FY 23 performance -

- Q1-FY23 financials were impacted primarily due to the unfortunate blast at Chlorination plant in Sarigam leading to shutdown for an extensive period of time, as well as subdued demand of hydrogenation products and mandatory maintenance shut down at one of Ammonolysis plant

- The Sarigram plant has resumed partial operations since 21st July 2022, although it will take a few weeks to restore to normalcy due to ordering/delivery/erection of new machinery. The cost of damage and loss of business is covered under insurance

- Price volatility stabilized to a certain extent in Q1-FY23 for key raw materials and the positive impact of this will be seen in the quarters ahead if the market dynamics continue to remain the same

Recently, we released our new stock recommendation for our Premium Members. It's a leading Pharmaceutical company with global leadership in its product segment, net debt free and available at very reasonable valuations. Can read about the company HERE

Disclaimer: This is not a recommendation to buy/sell Valiant Organics. These notes are as announced by the companies on exchanges and only for the purpose of information and education.

Best Regards,

Ekansh Mittal

Research Analyst

Web: https://www.katalystwealth.

SEBI Research Analyst Registration No. INH100001690

Research Analyst Details

Name: Ekansh Mittal Email Id: [email protected] Ph: +91 727 5050062

Details of Associate: Not Applicable

Analyst Certification: The Analyst certify (ies) that the views expressed herein accurately reflect his (their) personal view(s) about the subject security (ies) and issuer(s) and that no part of his (their) compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report.

Disclaimer: http://www.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Ekansh Mittal/Mittal Consulting/Katalyst Wealth is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any other person in any form. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Ekansh Mittal or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Neither Ekansh Mittal, nor its employees, agents nor representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. Ekansh Mittal/Mittal Consulting or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement.

The recipients of this report should rely on their own investigations. Ekansh Mittal/Mittal Consulting and/or its affiliates and/or employees may have interests/ positions, financial or otherwise in the securities mentioned in this report. Mittal Consulting has incorporated adequate disclosures in this document. This should, however, not be treated as endorsement of the views expressed in the report.

We submit that no material disciplinary action has been taken on Ekansh Mittal by any regulatory authority impacting Equity Research Analysis.

Disclaimer: You can access it here - LINK

Whether the research analyst or research entity or his associate or his relative has any financial interest in the subject company/companies and the nature of such financial interest – No

Whether the research analyst or research entity or his associates or his relatives have actual/beneficial ownership of 1% or more securities of the subject company (at the end of the month immediately preceding the date of publication of the research report or date of the public appearance) – No

Whether the research analyst or research entity or his associate or his relative has any other material conflict of interest at the time of publication of the research report or at the time of public appearance – No

Whether it or its associates have received any compensation from the subject company in the past twelve months – No

Whether it or its associates have managed or co-managed public offering of securities for the subject company in the past 12 months – No

Whether it or its associates have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether it or its associates have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past 12 months – No

Whether the subject company is or was a client during twelve months preceding the date of distribution of the research report and the types of services provided – No

Whether the research analyst has served as an officer, director or employee of the subject company – No

Whether the research analyst or research entity has been engaged in market making activity for the subject company – No