[Stock idea]: Control Print – Quiet Compounding Business Most Investors Ignore

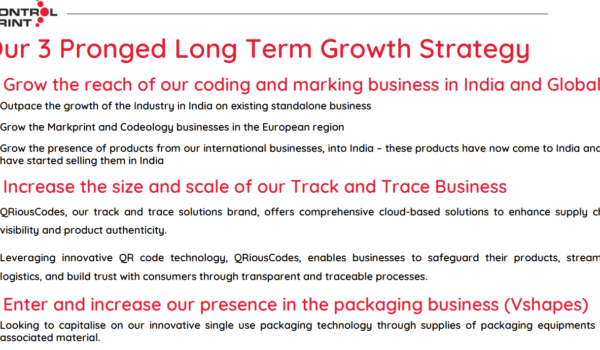

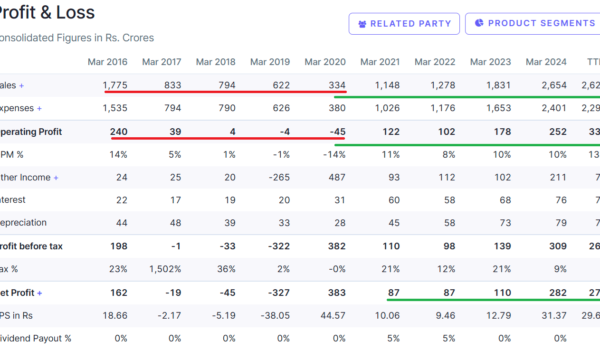

Control Print has been a long-tracked name for us. We recommended the stock to our Premium Members in 2014 at around Rs 55 levels and exited coverage in 2024 at roughly Rs 800 levels. Over this period, the company also returned Rs 60+ per share through dividends, underlining the role of steady cash flows in long-term compounding. Recently, Control Print reported a steady operating performance in Q3 and 9M FY26, supported by growth in its core coding & marking business and improved profitability at the standalone level. Below is a detailed,…