[Stock idea]: Godawari Power & Ispat: Mining License Could Be a Game-Changer — Here’s Why

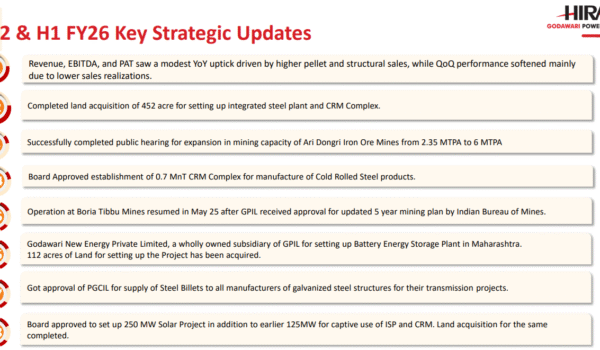

Recently, while screening for stocks for our Premium Members, I came across Godawari Power & Ispat. The company is engaged in the business of mining of Iron Ore and manufacturing of Iron Ore Pellets, Sponge Iron, Steel Billets, etc. with generation of Electricity. What caught my attention was company recently allotted 2.04 crore warrants at Rs 245/- per warrant and promoters subscribed to 48% of the same. Further, company will soon expand its mining capacity from 3 MTPA to 6 MTPA. Preview: How…