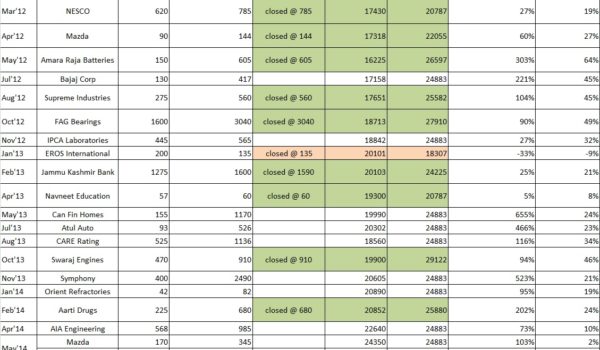

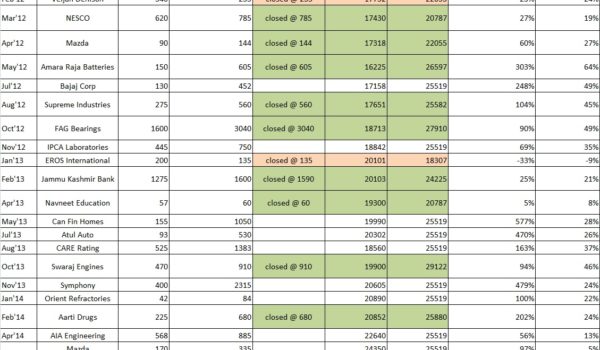

Alpha+: Research Reports status as in Apr’16 – Focus on stocks, not on Index

Dear Readers, Please find below the status of Special situation & Long/Medium term Research reports on stocks made in Alpha+ as on 6th Apr’16. The status is updated on monthly basis. Our focus on high quality businesses has helped us find stocks which have consistently outperformed benchmark indices by a very wide margin. This is not an investment advice and is a track record of research reports initiated by us. The performance data quoted represents past performance and does not…