Aarti – 5x in 2.5 years…Coverage closure update

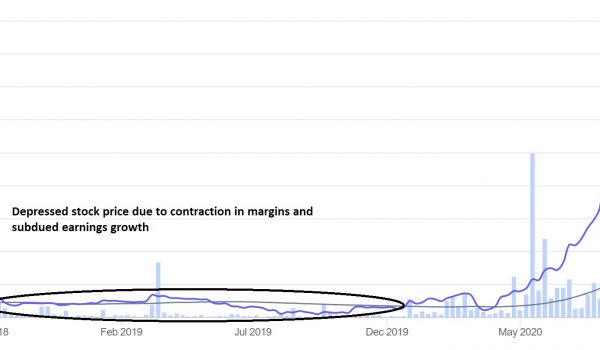

Dear Sir, In Sep’18 we initiated coverage on Aarti, leading API manufacturer, for our Premium Members. You can read the detailed initiation report on the company at the following LINK Recently, on 5th Feb’21, we finally closed the coverage on the stock and booked complete profit in our Model Sheets as well. The company has been a great wealth creator for us and our members. We first initiated coverage on the same in Feb’14 around 27-28 odd levels (adjusted for…