Google trend: Multibagger stocks…Such a good indicator for Contrarian Investors

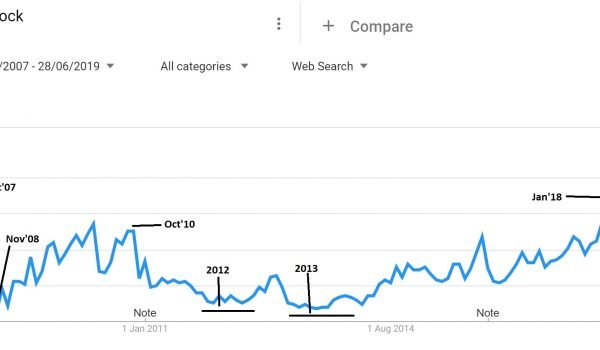

Dear Sir, Below is a graph from Google trends for the search term “Multibagger stocks”. The graph basically indicates the interest in the term “Multibagger stocks” over a period of time. So, as the graph indicates, more users searched the term in Dec’07, Oct’10 and Jan’18. Similarly, the interest in the term was lowest in Nov’08, for most of the 2012 and 2013 and now in 2019. Frankly, when I started looking for this kind of data, I didn’t expect…