6th Nov’20 – Sep’20 earnings update on Suven Pharma and Can Fin Homes

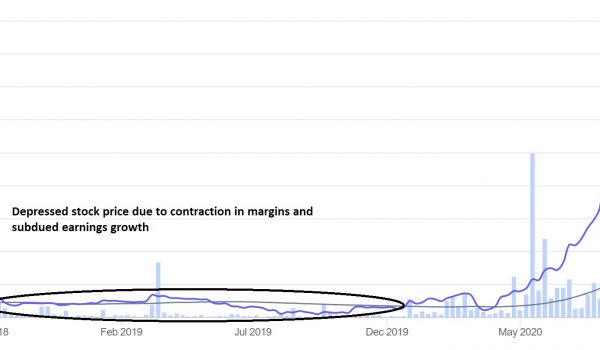

Dear Members, We have released 6th Nov’20 – Sep’20 earnings update on Suven Pharmaceuticals and Can Fin Homes. For other updates, please refer the following link – https://katalystwealth.com/category/latest-updates/ Date: 6th Nov’20 Suven Pharmaceuticals (NSE – SUVENPHAR) – May’17 Alpha stock CMP – 325.75 (BSE); 326.60 (NSE) Rating – Positive – 5% weightage; this is not an investment advice (refer rating interpretation) Source: bseindia.com Suven Pharmaceuticals got demerged from Suven Lifesciences with the entire revenue generating businesses consisting of CRAMS,…