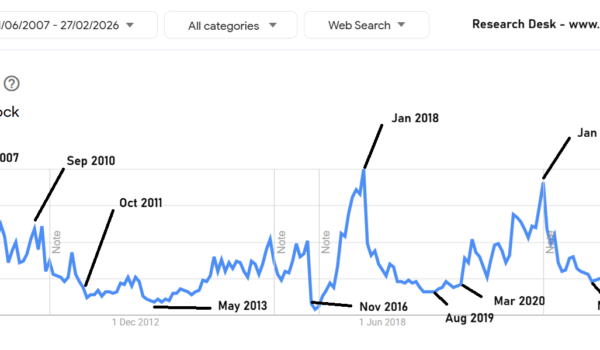

March 2026: The Same Signal That Worked in 2013 and March 2020

I want to share something unusual with you today — a contrarian indicator I’ve been tracking for years that has an almost perfect track record of calling market tops and bottoms. It’s not a technical indicator. It’s not fund flow data. It’s not insider buying. It’s Google search trends. Specifically: How often retail investors in India search for the term “Multibagger stock.” Let me show you what 19 years of data reveals — and what it’s telling us right now…